Growth vs Value Investing

In the article “what is a stock”, we mentioned growth stocks and value stocks. This differentiation applies to two different approaches to allocate money in the market, even creating two competing schools of thought.

When we talk about growth, we are defining a quick, fast, nervous growth approach, popular in today's start-ups such as Uber, Tesla, and all the other New Economy companies.

The value approach, in contrast, is based on slow steady growth. More on a kind of Warren Buffet vision.

These two approaches, so different from each other, can obviously be divided into different strategies or be mixed in the average investor's portfolio. The important thing is to grow our capital.

We can define the investor's most suitable approach based on 3 characteristics:

1 the growth of the company underlying the stock.

In this case, our focus will be directed at the company's economic growth and returns. This is a Growth approach when these characteristics outperform other companies in the same market or beat the market itself. It is the obsessive search for the new Apple to revolutionize the industry.

Investors look for companies with a couple of years of rapid growth, and these companies will in most cases be smaller and younger and leaner than their competitors.

In contrast, Value investors are not interested in these mirabulous performances but aim for more mature and stable companies with slower growths.

2 Valuing the 'stock

To be a value investor is to be a bargain hunter, buying low for stocks of higher intrinsic value than the market now prices. In the mindset of the value investor, you don't buy stocks just because they are cheap but because there is a study and a search for value behind them.

Growth stocks tend to be much more expensive, but the 'investor will be pay this price because he expects exponential upside.

3 price volatility

growth stocks in most cases suffer from higher volatility than value stocks. This is because Growth stocks have a higher inherent risk given the fundamentals of start-up companies that are not yet established.

the growth approach is a riskier approach, although it may be the one that pays the most if you are buying a company that will have exponential growth over the years

growth stocks are usually sold and bought based on promises. Promises of growth, turnover, and market position. But promises are not always kept.

the value approach is more time-consuming and much more boring, with low volatility and little market excitement.

what is the best approach? depends on the period you are considering, how much risk you are willing to expose yourself to, and what kind of companies you are analyzing. A mix of the two methods might be the right choice, while a single growth approach in a specific sector that is growing is risky but in principle profitable. Hopefully.

Stock Market Index

The CAC40 makes +3%. The SP500 is down 5%.

OK, but what is the SP500 and the CAC40? They are stock market indexes.

A stock market index is a numerical measure of a group of stocks merged together.

Stock indixes are a summary of the value of the stocks they represent. The movements of the index is a good approximation of the changing value of the stocks included in the portfolio over time. There are different methodologies for calculating indexes, depending on the weighting given to the stocks in the basket

This measure is used to monitor the performance of the indicated group of stocks more quickly. In fact, the change in the unit of measurement gives a rough indication of the performance of the market we are monitoring or in which we have invested. In reality the number itself that we see does not indicate much in general and can be taken as a pure point of reference in certain analyses, but what we are interested in is the percentage of movement.

Indices are many and can represent the stocks of a country or a geographic area or an industry sector and investing directly in the index is feasible to get a return from the market.

Some indexes are among the best representations of a country's industrial performance, such as the SP500 for the united states

In contrast, some other list is not as representative because of the characteristics of the country's industrialization in particular. This characteristic can be applied to other countries that are affected by the same of type of industrialization or other types of economies that are more skewed toward particular sectors, such as banking or tourism.

To get a return from these markets you can buy index funds, which is equivalent to buying the total index. Sometimes it does not make sense to buy the individual stock but rather the total sector or country.

An index fund can be a mutual fund or etf that copies the stock composition of the index, this makes the investor, with this product, follow the market trend.

Of course we should not buy random things on the wave of enthusiasm, before we buy a basket we have to make sure what is in that 'index and understand its exposure. If we buy a technology index we will be exposed to all the risks of that sector, whereas if we focus on the Indian index, we will also be exposed to its country risk.

Then we have to consider how these indexes are created and how the various stocks within it are weighted.

What is a stock?

When we hear about financial markets and stock values on the news, we often pay attention only to the numbers and percentages, marveling at vigorous rises or destructive falls, but what do these numbers refer to when it comes to stocks?

What are stocks?

A stock, in finance, is a financial security representing a share in the ownership of a corporation. is a financial asset representing a percentage of ownership of a company.

So, as explained in the article on IPOs, companies sell their shares to recover funds. Kind of like what is done with bonds, but there are major differences. The only part in common is the need to drain funds for the company.

Since a stock indicates ownership of a piece of the company represented, the percentage you own depends on the number of those specific stocks you have in your portfolio.

the basic idea is quite simple

at the end of the year or at the close of the fiscal year, the money the company has made, after all expenses have been removed, is owned by the shareholders. These profits have to trickle down to the holders and have only two paths, dividends and capital growth

Assuming a profit of 10 million in the year just ended, the company may decide to split this figure in half. 5 million is distributed through dividends to shareholders while the other 5 million is reinvested into the company.

the company with this money can develop a new product or cheaper methods of production. this should lead to creating more profitability in the company and this has an effect on the price of the individual share, driving it up in price and allowing the small investor to sell it at a higher price.

Obviously as is easy to understand , having a preponderant amount of stock allows you to have a say in what the company does, being able to direct money management decisions. Shareholders must be happy.

Like any business sector, there are companies that are more or less solid and behave differently depending on the period. A health care company is different from one that makes cell phone apps.

Geographic location is also important, as a Western company will behave differently from one in a developing country.

Then there are two big definitions for stocks, namely growth stocks and value stocks

Growth stocks are stocks of young and small companies that have greater potential to grow in the future.

So-called value stocks are of established companies that have a history behind them and generally pay large dividends to shareholders.

Stock dividends are not to be considered the same as bond yields. In fact, dividends are a choice of the company to give money to its shareholders and not an obligation as in the case of bonds, an obligation that if not met leads to the default of the issuer.

IPO

If a company needs money, one way to avoid getting bogged down by going into debt, or further debt, is to become a Public Company or to going public offering shares of the company on the market.

These operations are called IPOs or initial public offering.

It is not exactly a very simple thing and indeed there are a lot of bureaucratic steps and tons of paperwork to fill out, however, for popular sentiment an IPO is a demonstration of business and also personal success on the part of the owner.

Let's go through an example on how to list on the U.S. market.

Step 1- Investment Banker

Investment Bankers are an individual or group of individuals, whom we can refer to for convenience as "early investors," who help the company informally raise initial capital. The goal is to recover as much capital as possible, with the banker doing all that follows to promote the IPO.

Step 2-documentation

A registration document with the SEC commission will then have to be drawn up.

this document will be devoted to all the details of the company's operation, to explain in detail the company's operations, management and its financing prior to the IPO transaction. An identity card will then have to be created for the financial authorities.

the SEC will obviously investigate to see whether there is true or false information in the document, only designed to defraud the public. The SEC must also understand whether the listing is feasible based on the financial stability of the Company, to protect investors.

If all goes well, a listing date is decided.

Step 3 - create a document for the public

the banker, after approval by the SEC, should create a document for the public with a description of the company, with its operations, current performance, and on projected future operations.

the document will be circulated into investment institutions and larger investors. This is just to begin to create interest

This does create the so-called indication of interest, to see how many stocks people are willing to buy and at what price

This is to make sure that the selling price of the stock is well calibrated when they are listed on the market, this also makes the allocation of the shares defined, that is, how many are sold

IPOs also suffer from the hype of the moment. Our company may be on the top level and be particularly fashionable, this will be reflected in its listing price. A big ask might be a problem for the average investor, and too high a price might not be a sensible purchase.

On the contrary, an IPO of a company that receives lukewarm or no feedback may also be postponed precisely because the forecast for market collection is really unsatisfactory.

IPOs, like any financial transaction, have inherent risks for the average investor. They need to be well researched and understood, especially if it makes sense to jump in at a moment of hype.

XRP and Ripple

There is a coin in the cryptocurrency world that is considered a cryptocurrency when in fact it is not.

We are talking about XRP, created by the company Ripple. In common parlance XRP and Ripple have become synonymous, but the token's only name is XRP. This coin was not created with the idea of being a more functional alternative to Bitcoin, but to be a tool in the hands of the banking world by creating an alternative system to Swift.

XRP is not a real cryptocurrency because it is not totally decentralized.

In fact, Ripple began in 2012 as a system for transferring funds through a network for currency exchanges. In September 2018, Ripple was the second largest coin in the cryptocurrency market by market capitalization.

Ripple controls and manages XRP and has agreements with banks around the world. its code is open source and the value of the coin is affected by the value that is also assigned to the company.

Ripple was created solely to replace old systems such as swift, western union and moneygram with a cheaper system. Not all banks are connected to each other in the world with a single system. This forces banks to switch between different intermediaries in different countries, with long time and big cost for every transactions.

XRP is not created to be a store of value or to make transactions between economic actors in the real market but as a technical tool for specific banking actors or Payment Systems, companies, corporations, currency exchanges.

Because of its characteristics, Xrp cannot be mined but is a pre-mined currency. XRP is fast and scalable, in fact transactions in XRP take about 4 seconds versus 5-10 minutes for btc

XRP's wallet works with a minimum deposit of 20 XRP, an sistem created to avoid inordinate growth of accounts on its network for the sole purpose of clogging up the network and slowing it down.

The token is divisible up to 6 digits after zeros and some XRPs are destroyed after each operation, another system to protect the network. In the event of an attack, with thousands of useless transactions for the sole purpose of slowing down network, this system drains the accounts of the addresses that create the transactions.

Ripple's protocol is called rtxp Ripple Transaction Protocol and consists of pcs called validators that manage the network with their shared ledgers. Companies wishing to use Ripple's network must use gateways, which are points managed by banks and useful to those outside the network.

Ripple Labs was created only to offer banks various types of products, in fact RXTP is open source but the ripple products offered to banks are not and are created and developed only by ripple labs.

What is a currency?

Dollars, euros, pounds, marks, lire, sesterces and florins

Coins and their names have always been synonymous of wealth. But what is currency?

Today when we talk about currency, we think about the 10 dollars bill, but many of us think of ATM and credit cards. But currency is the fuel of every modern economy and is the unit of measure for the production of goods and services.

To understand the economic value of a good or service we use Currency as the unit of measure to make comparisons between different assets. We must then remember that broadly speaking when we have too much currency we suffer the phenomenon of 'inflation while when we have too little currency we suffer deflation. In theory.

It should be remembered that today's currency is issued by central banks against the transfer of collateral i.e. government bonds, so this currency is borrowed or rather created as loan, which generates debt.

Thousands of years ago, before the invention of currency, the 'economy was based on barter, which, however, was not an efficient system given the various things to be bartered. If I own 3 eggs and I need a cow for my farm, well barter becomes a system that makes at least one party interested in the exchange unhappy. The exchange becomes impossible and I will never get the cow I need. And the eggs rot.

Now given the impossibility of applying the system all exchanges, what we call "currency" was invented to solve every problem. With X number of coins I can go to my friend and get the cow I am interested in, so the same coins can be used by my friend to pay the worker to fix his farm that is falling apart.

Coins also, in 'antiquity but also until recently, had an intrinsic value determined by the value of gold and silver used for minting.

Coins, however, are a difficult commodity to carry around in large quantities; they can be stolen or lost. Buying a loaf of bread or a palace, requires a large difference in the quantity of coins. To overcome these problems, checks were born, which later turned into today's banknotes.

We have condensed the story as much as possible for ease of understanding.

Each banknote guaranteed the existence of its gold value at the issuer's depository.

in 1944, at the height of World War II, the monetary system was changed at Bretton Woods, and the only currency convertible into gold becomes the U.S. dollar with all other currencies pegged to it

in 1971 nixon abandoned gold convertibility for the dollar to avoid default because US was involved in the Vietnam War. On that day the fiat currency was born, or perhaps it would be better to say returned to the stage of history, whose value is given by trust in the 'authority that imposes its use, thus the government that issues it.

there are no more limits in the creation of money, being able to print as much currency as one wants and needs since the currency is created by the central bank of a country, in this case if we are talking about Europe , by the ECB.

In the history of our planet and of our civilization, kings, sovereigns and emperors had the ability to create the currency, and then this ability moved on to lordships and governments , and now end up with central banks that are private entities.

To date, the value of the currency is given by the international exchanges that take place between the various states, which implies considering the strength of the various economies as well.An increase in the value of a country's currency will make the purchase of its goods and services abroad, by a foreign citizen with lower value currency more difficult. The higher the value of the currency, the higher the price of goods that will be exported. One of the unfair activities you can do is to artificially keep the value of your currency low to increase exports by going to devalue it. And yes I am talking about you, China!

This is where Bitcoin comes in, which is a "currency" that we can describe as special. In fact, nothing like it has ever been created in the history of 'man, while the economic history books are full of fiat currency experiments that failed. Go look at what happened a few decades before the French Revolution....

In fact bitcoin possesses two characteristics that are unique compared to fiat currency, namely its decentralization and its deflationary nature.

No one controls the protocol nor can anyone change its characteristics by issuing more or less coin than those decided in the protocol. The protocol can be modified but all users must agree to the modification.

In the long run, the deflative nature of bitcoin makes it an excellent tool for long-term savings.

Brief history of the PetroDollar

Today we are going to give you a brief history of the monetary system we live in, better known as the PetroDollar system. Simple explanation to understand a little better the world we are immersed in and we take for granted.

The PetroDollar system is created as all commodities on the planet to be bought and sold in U.S. dollars, which is the currency printed by the United States of America.

To understand why we live in this sistem, we must go back in time to the early 1940s.

The world was involved into World War II, fighting was going on almost everywhere, and the Allies were about to attack German-occupied territories. The most industrialized and powerful country on the planet at that time was the United States, ousting the United Kingdom from its throne as the world leader and dominant empire on the planet.

In 1944, with the Bretton Woods agreements, it is decreed that the dollar will be the world currency pegged to gold when the war is over and consequently all other currencies will be pegged to the U.S. dollar.

With the war over,we had a period of prosperity and economic revival. The fabulous 1950s.

Years go by, however, and we come to the 1970s. The world is divided into two blocks, the Western block versus the Soviet block countries, and all over the world there are more or less heated skirmishes and clashes.

The hottest place on the planet is Vietnam, which sees massive intervention by the United States in open warfare to prevent the Soviet threat from taking over all of Southeast Asia. But this massive effort costs dearly, and the U.S. spends billions of dollars, printing and printing.

Nixon on August 15, 1971, in a surprise move, eliminates gold convertibility of the dollar. Of course it was a "temporary" measure to get out of the crisis. But the United States remains the country in charge of the planet, and our economic planet needs a specific raw material to make the economy work. Oil.

In 1973 Saudi Arabia and the United States agreed to sell oil on the world market exclusively in U.S. dollars. This supports the world demand for dollars since any country wishing to buy oil will have to exchange its currency for dollars and then buy the oil. This system then applies to all raw materials needed for a developed industry. This is also a way of geopolitics control in addition to the presence of military bases in various countries.

The U.S. presence in Saudi Arabia protects the Saudi royal house and the country from all kinds of aggression, since not all countries in the world are aligned with Washington's policy or wish to sell their oil under this system.

The greater the demand for oil, the greater the demand for dollars in the world becomes.

It must be said that some countries such as China and Russia are trying or have succeeded in getting out of this system, but we are talking expressly about the major competitors to the world leadership of the planet.

Let's make it a million euros!

Let's make it a million euros! Or dollar if you prefer!

Everyone wants money, everyone wants million dollars accounts, everyone wants Lamborghinis and yachts full of happy and nice young ladies. Well almost everyone, maybe the girls don't. I dont know.

Anyway back to reality, how do you build a million dollars account?

Let's try to create a list of ideas to reach our goal. Let's start dreaming with a look at the practical side.

Boom!!! We win the lottery!!!!

Or no...

First we need to do the math. If we work we need to see how soon we can reach this figure with the earnings from our job, obviously taking out taxes, expenses, mortgage, vacation, etc.

If we don't work, well we'd better look for a job first.

After that we have to find a way to grow our money in the bank, so we have to start investing. But before investing, we need to study.

So let's read all the CyMood articles and watch all the videos.

Now that we are less stupid we can start putting some money in the market. And now comes the hardest part.

We have to change our mindset, we have to operate on our emotional side. We have to accept that there will be painful losses, financially speaking. We have to understand that we will experience bad times when our investments will be into the negative zone, written on our screen in a blood red color.

But here we will have to believe in ourselves and see ourselves in a much better future than we have now. This vision serves to stimulate and push us to do better and not let us get depressed.

We tell ourselves a little lie, only to fool our brain to push us where we want to go. It is something difficult and uncomfortable for us but it has to be done.

The emotional part is the most difficult side. You may know the theory just fine, but your actions will always be driven by panic, greed and fear of losing your money. You must make sure that these emotions are kept silent in your soul in order to approach problems without emotions. Turning big problems into smaller ones.

Emotion will kill your trading account.

And always remember to use stop losses.

Another element that must never be lacking is Patience.

Patience is the basis for everything. Wanting everything right away is useless,as well as impossible.

Studying is fundamental, giving yourself time to learn is the basement of success.

Patience and study create a tool that is fundamental. The ability to adapt. Capacity that is given by the perception of the market and what goes around it.

You cannot expect to make money if you do not understand the environment in which you operate.

Adapting therefore means improving yourself. And improving yourself is another key element. The more you grow, the more capable and good you will be.

After that you will have to be judicious and disciplined. Discipline will help you through all your phases, from the best to the worst.

You will also need luck. It is undeniable, but often what others call luck is really just the result of a lot of hard, stressful work done behind the scenes to make sure you are in the right place at the right time. Remember that you see the road you have traveled, while others see only the end result.

The road you have traveled is the real goal. Not the money.

You have come a long way, changed for the better, and developed skills and knowledge that you did not have before. The money is the logical consequence.

The Scam List - A guide to avoid scam - Part 6

Instagram and Paypal scam

This Scam cost us $10.

Not because we didn't realize it was a scam, but only because the situation had become so funny and absurd that we wanted to see how it would end.

Let's start from the beginning. Like many of you, I have an account on instagram where I rarely post content that makes me and my friends laugh. It is a very normal account that has very few followers and i know all ot them.

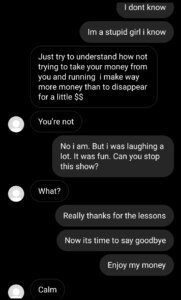

I get a message from a stranger who wants to buy pictures of my feet from me. For the incredible sum of $1,500. I am a boy but he thinks I am a girl and I can also understand the kink but the amount is too high. Curiosity was stronger than me and I let him write.

Our friend, let's call him by his nickname Randy, convinces me that he is a serious buyer and wants to pay immediately, despite me buying time by promising him photos and payment a few days later.

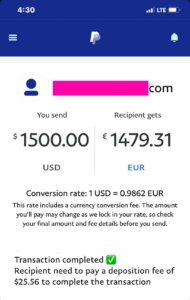

He starts insisting that he wants my paypal address, after a couple of hours I show him my address and Randy sends me a screenshot of Paypal where there is a money transfer of $1500. The strange thing is that underneathm there is a note where it says that I, the recipient, have to pay a $10 fee to receive the money.

The screen is clearly an edited screenshot of a real money transfer, not yet formalized, with the fee part added.

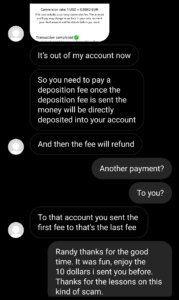

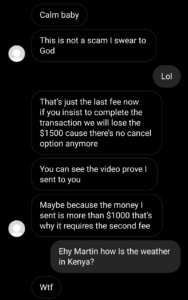

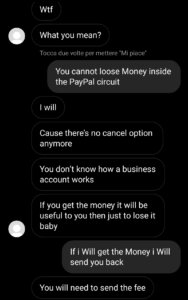

I start asking more about the fee only to see the scammer's reaction. Our friend Randy began storming me with messages, telling me that now that I had the money in the account I was no longer responding and that I was the scammer. The fee , according to him, was motivated by the fact that he had a business account and, because of this fact, Paypal worked this way. And this was not true.

Plus The push to me to pay the $10 was very strong. Here we have another element to pay attention to.

After a while I decide to send him this $10, obviously knowing I'm going to throw it away. I send the $10, as Randy tells me, with the "send to a friend" solution (so without the possibility of being able to get it back) and he asks me for a screenshot.

Randy disappears for half an hour, probably he moves the $10 into another account, and in the meantime he prepares another screenshot for me. In fact, after a short time I get another screenshot of the payment but now with another 25 dollar fee.

It becomes apparent that the vicious cycle becomes unstoppable, and that the payment fees will rise in value exponentially. That said, I declined payment and Randy in despair accused me of trying to make him lose his $1500. Another impossible thing, since if the money was in the Paypal loop, it would go back to the sending party.

That said, I ended it all by thanking Randy for the lesson and the fun.

To recap, as you can see, this scam is based on ignorance of how Paypal works, absurd excuses, and the haste and pressure created by the scammer on the victim. If you have used Paypal you know that any fees are charged to the payer, not the recipient. Just the initial situation alone was so absurd that it could only be a scam.

The next day we got the exact same scam again, from another user who always wanted to buy pictures of my feet (I still don't understand why). The pattern was the same, the only difference being that in this case the payment fee was justified by the fact that the paypal account was in cryptocurrency and not USD.

This is all fantastic

Ethereum

Vitalik Buterin has given to the world one of the platforms with one of the biggest potentials on the planet. Ethereum has a very interesting future ahead of it.

Ethereum, whose currency is called Eth, is not only on par with btc a currency for exchanging value, but it is a decentralized platform for creating complex applications. In fact, the goal of ethereum is to decentralize the Internet from the network giants of today.

Ethereum is a decentralized platform for the creation and peer-to-peer publication of smart contracts, or in short, contracts that are self-executing and self-fulfilling. The applications of these contracts are and will be of an enormous number and will cover Gaming and gambling, various contracts, certifications, voting, real estate records and much more.

Even the famous ICOs are actually very simple smart contracts tied to the written code base. This code makes the contract immutable once deployed on the network and after blockchain approval.

Complicated smart contracts have a very high inherent level of difficulty and a huge need for security. You have to create perfect programming and be sure that the contract does only what the programmer has decided. Always remember that Code is Law.

The principle behind Ethereum is that since it is a decentralized platform for program development, anyone can create a program that cannot be controlled by any person or group and that program will run on Eth's network. With a little study of Solidity, all intermediaries can be eliminated and developers can work directly on the Blockchain.

Ethereum was launched in July 2015 and has since become the second largest cryptocurrency by capitalization. Its potential is extremely interesting and deserves to be followed .

A lot of applications are being developed on the ethereum network, from DEFI to NFT tokens to decentralized exchanges that are used to exchange tokens of different types, on the same network, eliminating the trust problem of a centralized exchange.

Ethereum's ease of programming has meant that thousands of other coins, which we can call tokens or altcoins depending on the situation, have sprung up on its network.

Tokens can be defined as the tokens for slot machine, and there are different types of crypto tokens. If we take our cue from Finma, the Swiss regulator, we can define them into 3 categories.

- payment tokens not linked to other functions i.e. Bitcoin, Ethereum, Litecoin. These are real coins, born for value exchange.

- utility tokens that serve a single platform or digital service such as Ripple's XRP, or Binance's BNB, and can be exchanged outside their native platform.

- Investment tokens, which, on the other hand, represent asset values, such as shares in real assets, companies, revenues, or the right to dividends or interest payments. These tokens should be considered in relation to their economic function, in a similar way to shares or corporate bonds, or a derivative financial instrument.