How Cryptocurrencies Work

Few people know or remember, that cryptocurrencies originated as a derivative product of another invention. In fact, Satoshi Nakamoto had no intention of inventing another currency.

The most important part of his invention, when he gave the world the whitepaper of bitcoin or” A Peer-to-Peer Electronic Cash System" was that he managed to create a way to create a decentralized payment system. Throughout the 90s of the 20th century, attempts were made to create a digital system, but all these attempts failed miserably. But developing a system as if it were a peer-to-peer file exchange was the right choice

To set up a payment network you need accounts, user profiles and transactions. Easy to understand but then the biggest issue is to prevent users from spending the same money twice with different entities. To solve this, we use a central server that keeps track of all user balances. But if we do not have this authority or do not want a central entity to certify and monitor users, how do we solve the problem?

In a peer-to-peer network, every single node must have a list of transactions and check that they are valid. Most importantly, all nodes must agree with the approved transactions, because otherwise the network immediately collapses.

No one knew how to solve this network consensus problem until 'Satoshi's invention.

If we take away all the marketing and halo of mystery around cryptocurrencies, and go to the 'bones of their definition , we could define them as "a database with limited writeability within it that no one can change unless it meets specific conditions." This sounds like the definition of a bank account in any bank.

To give a correct definition, cryptocurrencies are a method of exchanging value based on internet technology, which use cryptography to carry out financial transactions that are decentralized, transparent and immutable thanks to blockchain technology.

In currencies such as Bitcoin, the database is managed by the various nodes in the network. Each node has a shared ledger inside which the values of each account and the transactions made are put. Transactions are files that say Gigi gave Y btc to Pancrazio and this transaction was signed by Gigi's private key and then sent to the network.

The transaction is known immediately by the network but it takes some time to get it approved. Approval or rather confirmation of the transaction is one of the key parts of the technology. A confirmed transaction is immutable.

Only miners can confirm transactions, through the process called Mining. Mining involves closing blocks of transactions in the blockchain. Before doing this, however, miners must check the transactions, approve them and enter them into the network. When they are confirmed they become part of the blockchain. And to do this they receive other cryptocurrencies as payment.

Technically anyone can become a miner, since there is no central authority that can approve us or not. Of course it takes security rules to make sure that the network is not destroyed by those who have an interest in its demise. In the case of Bitcoin, the system is called proof of work, which is based on the SHA 256 Hash Algorithm and involves the miner finding a hash, to connect the closing block with the previous block. We can define it, to keep it simple, as a cryptographic puzzle to be solved. Solving it, the reward will be some bitcoins. And this is the only way to create new bitcoins.

Cryptography, therefore mathematics, makes the system secure.

So we are not talking about trust between humans, which can be bought or blackmailed. You cannot blackmail or kidnap the child of a mathematical operation.

Some of the most interesting properties of cryptocurrencies are:

Irreversibility: no one after confirmation can cancel a transaction. Wrong address? Nothing can be done about it. Your pc was stolen with the private key? Nothing can be done. The safety net is not there.

Pseudonymity: no account or transaction is connected to real life. However, if you have done a KYC somewhere, your identity is traceable.

Fast and global: transactions are virtually instantaneous, the speed of confirmation depends on the coin, but of ranges from second to 10 min in Bitcoin. They have no borders though since the network is global.

Secure: As long as you own the private key you are safe. Big coins are unlikely to be hacked unless there are deliberate bugs.

Permissionless: you don't have to ask anyone for permission to use your coins. No one can stop you from using them.

Limited Number of Coins: A good portion of cryptocurrencies have a limited supply, such as Bitcoin with its 21 million. In contrast, DOGE has an unlimited supply with a huge daily production. The limited supply is obviously an advantage in terms of maintaining value.

Think about how useful these properties can be to citizen freedom.

Death and Market

This article is purely an expression of my personal thoughts and a series of experiences that have been part of my life. These are thoughts put in order after seeing some online posts.

Boom.

Market crash.

Anxiety, panic, pain. Account zeroed out.

No prospects for the future. Our hopes are dead.

It's time to follow our hopes.

No. Absolutely NO.

There is no financial reason big enough for a small investor to end his or her life. The pain for this choice is much, much greater than anything else.

In my life I have met friends, with whom I shared many good times, who unfortunately years later, for healthy reasons, decided to end their lives.

I understand their point of view. They were facing a destructive time in their lives, the future was marked by a certain physical and mental decline that would reduce them to nothing.

Their choice was drastic, with a lot of depression and pain that they were unable to sustain.

However, I also saw that their pain pass to their families. Destroyed by sudden loss, by such great but unperceived distress. That hurt that afflicted my friends passed into the souls of their parents, who throughout the rest of their lives will wonder why and if they ever could have done anything different to change this horrible ending.

Whenever I see articles about some crash that leads to suicides I think of my friends' parents. And I reflexively think of the parents or families of those who have killed themselves for making financial mistakes. And I think of what they will go through in the future, the wave of grief and despair they will have to experience and endure.

There are no good reasons for a family man who has made financial mistakes to kill himself.

The most important thing is to try to be careful and vigilant and not put ourselves in conditions that corner us and that can be a source of despair and family destruction.

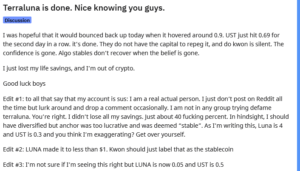

If we take one of the latest examples in the crypto world, namely the Terra crash, we see how part of the public staked everything on this assett, convinced that it would quickly lead them to instant wealth.

You know very well that this is not how it works, wealth is not a one moment thing, it is a long and difficult path. Putting all your eggs in one basket is self-destructive to your wallet.

I know the rush to be rich, I know the desire to possess, I know the thirst for money. These are all desires that only destroy who we are and lead us to make mistakes, sometimes huge ones that could sink us for good.

We have to control our psyche, control our desires and reason wisely.

There is always only one solution.

Risk control. Always at all times.

Emotion control.

Reality control.

Understanding that achieving wealth is a path and not a one-time event in our lives.

Doing the right thing. Before the inevitable end of your life.

I recently lost my father.

After a long illness, after a bad deterioration period of time, he passed away in a hospital bed in his sleep. Painlessly, in complete peace. And we were with him.

When a father dies in a family it is always a tragedy since generally the male figure is the one who guides the choices and direction of any economic nature and brings home the largest share of the family income.

After coming to terms with the pain of loss and dealing with everything that comes after a bereavement, I stopped one evening to think about my situation at the time.

My father's long illness, had allowed my mother and me to handle family matters as best we could. We had had plenty of time to do things right, but more importantly, to have an overview of our situation. That overview that is sometimes lacking in a family.

And I stopped to think about those families who go through bereavement and have not been as fortunate as I have been. How to do that in this case?

You who are reading, I assume that you are the one in the family who takes care of the boring financial matters. I assume that you are the one who makes the decisions and has the idea of the big picture. Let's start with what experience has taught me.

The first thing to consider is information asymmetry.

Since you are the one in the family dealing with these things, most likely your partner doesn't know anything about it. And that is not necessarily completely wrong. We have to consider the amount of things there are to do, the different interests of the two partners, and the personal predisposition of each.

But you have to consider, though, that the moment you are gone, your wife or husband will have to take over your financial management and they will have to put the pieces together and figure out what to do and who to talk to.

If I can give you a tip, try to leave everything written and create something foolproof.

Account numbers, passwords and logins, who to contact and why, trusted people to turn to who can help those who find themselves managing this situation.

These are trivial things that we don't think about, however. The basic principle is to handle this situation by trying to leave emotions aside and make the job easier for those who will be there after you.

Educating your wife or children about economics and investing, that is a good job to do. It will be difficult, especially if you lack motivation and desire.

Also because, let's face it. you are dead, you certainly can't suggest account passwords to your wife in her sleep.

Psychology, money and divorce

I was talking some time ago with a psychologist friend about how she was working more and more with couples or individuals who were going through the end of their marriage or were close to divorce. In the end, I realized that the main reasons that lead people to divorce are basically three and they are all issues related to Sex, Money, and Family. All issues that are mixed into a gigantic problem that destroys even the most loving couples.

Now I fully understand my friend's words and the situations she described. I cannot talk about family problems because every family is made differently, but money is the same for everyone. So is our reproductive system.

Managing the family budget is something delicate. Two people, with two different spending predispositions, come together wanting to start a family. These same people will have to profitably manage the money they themselves bring home.

The point is all about "managing profitably."

A person may be more predisposed to saving or to squandering. Going from the extreme of saving every penny to the other extreme of spending it all to the point of being left with bank account in deep red at the end of the month.

The issue of having a couple formed by the two extremes in the long run goes to create enormous tensions. As always, virtue lies in the middle, but the propensity to save is an innate quality and a behavior taught by parents.

In addition to how to spend money on everyday things, then go the choices and discussions for the long-term expenses that are considered important, namely house, car, and investments.

Things like changing the car every 2 or 3 years, looking for a beach house or deciding where to take the darn vacations.

Money is often an issue in every family, especially if one or more children are also involved. Making ends meet is crucial, as is ensuring an adequate amount in the children's future. If you want them to be educated in the right private school, you will need to have the right amount in the account.

Saving something is always important; making your wife or husband happy is equally so. But economic problems and the anxieties produced by these, in times of economic slowdown, become more and more acute. Anxieties and problems that are always reflected in the behavior of he or she in the family who administers and makes ends meet.

Think about it for a moment, if you are very worried about your economic situation, this worry will follow you everywhere, even during your quality time with your partner. Time that will no longer become quality time until it becomes nonexistent.

And after some time your partner will go looking for this quality time somewhere else. And you will end up being the second tier partner and usually end up breaking up.

Have you seen that loop? Money problems that become sex problems that become family problems. Complete destruction.

Of course, the description is overly simplistic. One cannot describe in totality the issues in a relationship and the various facets that each of us has that change behavior within a couple, but in broad strokes this example is a good picture of what happens.

What to do to avoid this?

When you have economic anxieties and issues, talk to your partner about it. He or she needs to be aware of the problem and understand why you are behaving a certain way. It may not be the easiest choice, but at least he will know that he needs to start cutting unnecessary expenses.

Explaining economic mistakes and errors is bad. Our egos will always suffer but heck, reality is reality and if you want to solve problems you must first accept that they exist. Dealing with problems and stress together can prevent 'misunderstandings and destructive or self-destructive behavior.

Having an emergency fund, large enough for a few months of survival, is always a good thing, and those who do not have it always take a risk that I find exaggerated.

A little available liquidity always makes sense. Especially now.