Growth vs Value Investing

In the article “what is a stock”, we mentioned growth stocks and value stocks. This differentiation applies to two different approaches to allocate money in the market, even creating two competing schools of thought.

When we talk about growth, we are defining a quick, fast, nervous growth approach, popular in today's start-ups such as Uber, Tesla, and all the other New Economy companies.

The value approach, in contrast, is based on slow steady growth. More on a kind of Warren Buffet vision.

These two approaches, so different from each other, can obviously be divided into different strategies or be mixed in the average investor's portfolio. The important thing is to grow our capital.

We can define the investor's most suitable approach based on 3 characteristics:

1 the growth of the company underlying the stock.

In this case, our focus will be directed at the company's economic growth and returns. This is a Growth approach when these characteristics outperform other companies in the same market or beat the market itself. It is the obsessive search for the new Apple to revolutionize the industry.

Investors look for companies with a couple of years of rapid growth, and these companies will in most cases be smaller and younger and leaner than their competitors.

In contrast, Value investors are not interested in these mirabulous performances but aim for more mature and stable companies with slower growths.

2 Valuing the 'stock

To be a value investor is to be a bargain hunter, buying low for stocks of higher intrinsic value than the market now prices. In the mindset of the value investor, you don't buy stocks just because they are cheap but because there is a study and a search for value behind them.

Growth stocks tend to be much more expensive, but the 'investor will be pay this price because he expects exponential upside.

3 price volatility

growth stocks in most cases suffer from higher volatility than value stocks. This is because Growth stocks have a higher inherent risk given the fundamentals of start-up companies that are not yet established.

the growth approach is a riskier approach, although it may be the one that pays the most if you are buying a company that will have exponential growth over the years

growth stocks are usually sold and bought based on promises. Promises of growth, turnover, and market position. But promises are not always kept.

the value approach is more time-consuming and much more boring, with low volatility and little market excitement.

what is the best approach? depends on the period you are considering, how much risk you are willing to expose yourself to, and what kind of companies you are analyzing. A mix of the two methods might be the right choice, while a single growth approach in a specific sector that is growing is risky but in principle profitable. Hopefully.

Stock Market Index

The CAC40 makes +3%. The SP500 is down 5%.

OK, but what is the SP500 and the CAC40? They are stock market indexes.

A stock market index is a numerical measure of a group of stocks merged together.

Stock indixes are a summary of the value of the stocks they represent. The movements of the index is a good approximation of the changing value of the stocks included in the portfolio over time. There are different methodologies for calculating indexes, depending on the weighting given to the stocks in the basket

This measure is used to monitor the performance of the indicated group of stocks more quickly. In fact, the change in the unit of measurement gives a rough indication of the performance of the market we are monitoring or in which we have invested. In reality the number itself that we see does not indicate much in general and can be taken as a pure point of reference in certain analyses, but what we are interested in is the percentage of movement.

Indices are many and can represent the stocks of a country or a geographic area or an industry sector and investing directly in the index is feasible to get a return from the market.

Some indexes are among the best representations of a country's industrial performance, such as the SP500 for the united states

In contrast, some other list is not as representative because of the characteristics of the country's industrialization in particular. This characteristic can be applied to other countries that are affected by the same of type of industrialization or other types of economies that are more skewed toward particular sectors, such as banking or tourism.

To get a return from these markets you can buy index funds, which is equivalent to buying the total index. Sometimes it does not make sense to buy the individual stock but rather the total sector or country.

An index fund can be a mutual fund or etf that copies the stock composition of the index, this makes the investor, with this product, follow the market trend.

Of course we should not buy random things on the wave of enthusiasm, before we buy a basket we have to make sure what is in that 'index and understand its exposure. If we buy a technology index we will be exposed to all the risks of that sector, whereas if we focus on the Indian index, we will also be exposed to its country risk.

Then we have to consider how these indexes are created and how the various stocks within it are weighted.

IPO

If a company needs money, one way to avoid getting bogged down by going into debt, or further debt, is to become a Public Company or to going public offering shares of the company on the market.

These operations are called IPOs or initial public offering.

It is not exactly a very simple thing and indeed there are a lot of bureaucratic steps and tons of paperwork to fill out, however, for popular sentiment an IPO is a demonstration of business and also personal success on the part of the owner.

Let's go through an example on how to list on the U.S. market.

Step 1- Investment Banker

Investment Bankers are an individual or group of individuals, whom we can refer to for convenience as "early investors," who help the company informally raise initial capital. The goal is to recover as much capital as possible, with the banker doing all that follows to promote the IPO.

Step 2-documentation

A registration document with the SEC commission will then have to be drawn up.

this document will be devoted to all the details of the company's operation, to explain in detail the company's operations, management and its financing prior to the IPO transaction. An identity card will then have to be created for the financial authorities.

the SEC will obviously investigate to see whether there is true or false information in the document, only designed to defraud the public. The SEC must also understand whether the listing is feasible based on the financial stability of the Company, to protect investors.

If all goes well, a listing date is decided.

Step 3 - create a document for the public

the banker, after approval by the SEC, should create a document for the public with a description of the company, with its operations, current performance, and on projected future operations.

the document will be circulated into investment institutions and larger investors. This is just to begin to create interest

This does create the so-called indication of interest, to see how many stocks people are willing to buy and at what price

This is to make sure that the selling price of the stock is well calibrated when they are listed on the market, this also makes the allocation of the shares defined, that is, how many are sold

IPOs also suffer from the hype of the moment. Our company may be on the top level and be particularly fashionable, this will be reflected in its listing price. A big ask might be a problem for the average investor, and too high a price might not be a sensible purchase.

On the contrary, an IPO of a company that receives lukewarm or no feedback may also be postponed precisely because the forecast for market collection is really unsatisfactory.

IPOs, like any financial transaction, have inherent risks for the average investor. They need to be well researched and understood, especially if it makes sense to jump in at a moment of hype.

Brief history of the PetroDollar

Today we are going to give you a brief history of the monetary system we live in, better known as the PetroDollar system. Simple explanation to understand a little better the world we are immersed in and we take for granted.

The PetroDollar system is created as all commodities on the planet to be bought and sold in U.S. dollars, which is the currency printed by the United States of America.

To understand why we live in this sistem, we must go back in time to the early 1940s.

The world was involved into World War II, fighting was going on almost everywhere, and the Allies were about to attack German-occupied territories. The most industrialized and powerful country on the planet at that time was the United States, ousting the United Kingdom from its throne as the world leader and dominant empire on the planet.

In 1944, with the Bretton Woods agreements, it is decreed that the dollar will be the world currency pegged to gold when the war is over and consequently all other currencies will be pegged to the U.S. dollar.

With the war over,we had a period of prosperity and economic revival. The fabulous 1950s.

Years go by, however, and we come to the 1970s. The world is divided into two blocks, the Western block versus the Soviet block countries, and all over the world there are more or less heated skirmishes and clashes.

The hottest place on the planet is Vietnam, which sees massive intervention by the United States in open warfare to prevent the Soviet threat from taking over all of Southeast Asia. But this massive effort costs dearly, and the U.S. spends billions of dollars, printing and printing.

Nixon on August 15, 1971, in a surprise move, eliminates gold convertibility of the dollar. Of course it was a "temporary" measure to get out of the crisis. But the United States remains the country in charge of the planet, and our economic planet needs a specific raw material to make the economy work. Oil.

In 1973 Saudi Arabia and the United States agreed to sell oil on the world market exclusively in U.S. dollars. This supports the world demand for dollars since any country wishing to buy oil will have to exchange its currency for dollars and then buy the oil. This system then applies to all raw materials needed for a developed industry. This is also a way of geopolitics control in addition to the presence of military bases in various countries.

The U.S. presence in Saudi Arabia protects the Saudi royal house and the country from all kinds of aggression, since not all countries in the world are aligned with Washington's policy or wish to sell their oil under this system.

The greater the demand for oil, the greater the demand for dollars in the world becomes.

It must be said that some countries such as China and Russia are trying or have succeeded in getting out of this system, but we are talking expressly about the major competitors to the world leadership of the planet.

Let's make it a million euros!

Let's make it a million euros! Or dollar if you prefer!

Everyone wants money, everyone wants million dollars accounts, everyone wants Lamborghinis and yachts full of happy and nice young ladies. Well almost everyone, maybe the girls don't. I dont know.

Anyway back to reality, how do you build a million dollars account?

Let's try to create a list of ideas to reach our goal. Let's start dreaming with a look at the practical side.

Boom!!! We win the lottery!!!!

Or no...

First we need to do the math. If we work we need to see how soon we can reach this figure with the earnings from our job, obviously taking out taxes, expenses, mortgage, vacation, etc.

If we don't work, well we'd better look for a job first.

After that we have to find a way to grow our money in the bank, so we have to start investing. But before investing, we need to study.

So let's read all the CyMood articles and watch all the videos.

Now that we are less stupid we can start putting some money in the market. And now comes the hardest part.

We have to change our mindset, we have to operate on our emotional side. We have to accept that there will be painful losses, financially speaking. We have to understand that we will experience bad times when our investments will be into the negative zone, written on our screen in a blood red color.

But here we will have to believe in ourselves and see ourselves in a much better future than we have now. This vision serves to stimulate and push us to do better and not let us get depressed.

We tell ourselves a little lie, only to fool our brain to push us where we want to go. It is something difficult and uncomfortable for us but it has to be done.

The emotional part is the most difficult side. You may know the theory just fine, but your actions will always be driven by panic, greed and fear of losing your money. You must make sure that these emotions are kept silent in your soul in order to approach problems without emotions. Turning big problems into smaller ones.

Emotion will kill your trading account.

And always remember to use stop losses.

Another element that must never be lacking is Patience.

Patience is the basis for everything. Wanting everything right away is useless,as well as impossible.

Studying is fundamental, giving yourself time to learn is the basement of success.

Patience and study create a tool that is fundamental. The ability to adapt. Capacity that is given by the perception of the market and what goes around it.

You cannot expect to make money if you do not understand the environment in which you operate.

Adapting therefore means improving yourself. And improving yourself is another key element. The more you grow, the more capable and good you will be.

After that you will have to be judicious and disciplined. Discipline will help you through all your phases, from the best to the worst.

You will also need luck. It is undeniable, but often what others call luck is really just the result of a lot of hard, stressful work done behind the scenes to make sure you are in the right place at the right time. Remember that you see the road you have traveled, while others see only the end result.

The road you have traveled is the real goal. Not the money.

You have come a long way, changed for the better, and developed skills and knowledge that you did not have before. The money is the logical consequence.

Death and Market

This article is purely an expression of my personal thoughts and a series of experiences that have been part of my life. These are thoughts put in order after seeing some online posts.

Boom.

Market crash.

Anxiety, panic, pain. Account zeroed out.

No prospects for the future. Our hopes are dead.

It's time to follow our hopes.

No. Absolutely NO.

There is no financial reason big enough for a small investor to end his or her life. The pain for this choice is much, much greater than anything else.

In my life I have met friends, with whom I shared many good times, who unfortunately years later, for healthy reasons, decided to end their lives.

I understand their point of view. They were facing a destructive time in their lives, the future was marked by a certain physical and mental decline that would reduce them to nothing.

Their choice was drastic, with a lot of depression and pain that they were unable to sustain.

However, I also saw that their pain pass to their families. Destroyed by sudden loss, by such great but unperceived distress. That hurt that afflicted my friends passed into the souls of their parents, who throughout the rest of their lives will wonder why and if they ever could have done anything different to change this horrible ending.

Whenever I see articles about some crash that leads to suicides I think of my friends' parents. And I reflexively think of the parents or families of those who have killed themselves for making financial mistakes. And I think of what they will go through in the future, the wave of grief and despair they will have to experience and endure.

There are no good reasons for a family man who has made financial mistakes to kill himself.

The most important thing is to try to be careful and vigilant and not put ourselves in conditions that corner us and that can be a source of despair and family destruction.

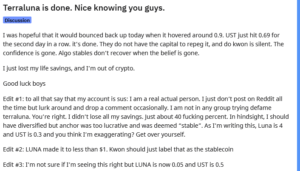

If we take one of the latest examples in the crypto world, namely the Terra crash, we see how part of the public staked everything on this assett, convinced that it would quickly lead them to instant wealth.

You know very well that this is not how it works, wealth is not a one moment thing, it is a long and difficult path. Putting all your eggs in one basket is self-destructive to your wallet.

I know the rush to be rich, I know the desire to possess, I know the thirst for money. These are all desires that only destroy who we are and lead us to make mistakes, sometimes huge ones that could sink us for good.

We have to control our psyche, control our desires and reason wisely.

There is always only one solution.

Risk control. Always at all times.

Emotion control.

Reality control.

Understanding that achieving wealth is a path and not a one-time event in our lives.

Psychology, money and divorce

I was talking some time ago with a psychologist friend about how she was working more and more with couples or individuals who were going through the end of their marriage or were close to divorce. In the end, I realized that the main reasons that lead people to divorce are basically three and they are all issues related to Sex, Money, and Family. All issues that are mixed into a gigantic problem that destroys even the most loving couples.

Now I fully understand my friend's words and the situations she described. I cannot talk about family problems because every family is made differently, but money is the same for everyone. So is our reproductive system.

Managing the family budget is something delicate. Two people, with two different spending predispositions, come together wanting to start a family. These same people will have to profitably manage the money they themselves bring home.

The point is all about "managing profitably."

A person may be more predisposed to saving or to squandering. Going from the extreme of saving every penny to the other extreme of spending it all to the point of being left with bank account in deep red at the end of the month.

The issue of having a couple formed by the two extremes in the long run goes to create enormous tensions. As always, virtue lies in the middle, but the propensity to save is an innate quality and a behavior taught by parents.

In addition to how to spend money on everyday things, then go the choices and discussions for the long-term expenses that are considered important, namely house, car, and investments.

Things like changing the car every 2 or 3 years, looking for a beach house or deciding where to take the darn vacations.

Money is often an issue in every family, especially if one or more children are also involved. Making ends meet is crucial, as is ensuring an adequate amount in the children's future. If you want them to be educated in the right private school, you will need to have the right amount in the account.

Saving something is always important; making your wife or husband happy is equally so. But economic problems and the anxieties produced by these, in times of economic slowdown, become more and more acute. Anxieties and problems that are always reflected in the behavior of he or she in the family who administers and makes ends meet.

Think about it for a moment, if you are very worried about your economic situation, this worry will follow you everywhere, even during your quality time with your partner. Time that will no longer become quality time until it becomes nonexistent.

And after some time your partner will go looking for this quality time somewhere else. And you will end up being the second tier partner and usually end up breaking up.

Have you seen that loop? Money problems that become sex problems that become family problems. Complete destruction.

Of course, the description is overly simplistic. One cannot describe in totality the issues in a relationship and the various facets that each of us has that change behavior within a couple, but in broad strokes this example is a good picture of what happens.

What to do to avoid this?

When you have economic anxieties and issues, talk to your partner about it. He or she needs to be aware of the problem and understand why you are behaving a certain way. It may not be the easiest choice, but at least he will know that he needs to start cutting unnecessary expenses.

Explaining economic mistakes and errors is bad. Our egos will always suffer but heck, reality is reality and if you want to solve problems you must first accept that they exist. Dealing with problems and stress together can prevent 'misunderstandings and destructive or self-destructive behavior.

Having an emergency fund, large enough for a few months of survival, is always a good thing, and those who do not have it always take a risk that I find exaggerated.

A little available liquidity always makes sense. Especially now.

What is finance?

What is finance?

Finance is a broad and complicated subject, made up of complicated mechanisms and skills but accessible if you have the willingness to learn and dedicate the right amount of time and sweat. Nothing is simple in this field, but understanding what goes on behind the scenes is basic to having a good method of investment and economic growth. It is time to understand the words and numbers given by the news on TV.

Finance is the economic discipline that study process and choices for investing. Investing is the financial activity that any individual who wish to increase his capital does, with the aim of increasing any monetary resources or to acquire other resources of different kinds.

Otherwise, financing is a transfer of money for economic activity that will lead to the repayment of the sum even increased.

Financial studies are concerned with the technical aspect of these processes, that is, the creation of prices, assett valuations and everything related to the strategies adopted to hedge risk, in technical terms defined hedging

When we talk about valuations we are referring to economic-financial analysis and planning to determine the feasibility and return on various investments by a person working in the market.

When we speak generically of finance, we immediately associate financial instruments, that is, products and instruments with which money exchanges take place between individuals, states and businesses, in places that are called financial markets.

These places, which were once physical like Wall Street in New York but now become mostly digital, have precise rules and authorized operators. There are regulators regarding compliance with market rules and there are companies that organize the market in this regulatory scheme that varies from state to state. In fact, these rules allow for the creation or not of different financial instruments.

These different financial instruments create different financial markets. If we talk about debt, we will have the bond market. If we talk about stocks we will have the stock market, if we talk about the currency market we will have forex, and so on down to commodities.

Always remember that being a market, we will have a seller and a buyer, in this case a large number of both. In between them are the financial brokers.

Every crypto exchange is a financial market.

The rise in interest rates. Maybe.

Today we're going to talk about interest rates.

At this moment in history, interest rates are at their lowest, they have never been lower.

By logic, something that goes down has to come back up, so what would happen in theory if interest rates were to go up again?

Let's start putting the pieces in order.

Central banks of nation around the world have various tasks and one of them is to stabilize economic activity and promote the prosperity of their own nation within the global economic competition.

One of the central bank's weapons is the control of interest rates, rates at which major banks lend money to smaller banks in what is called the overnight market.

This money will then be lent to other economic entities such as companies and individuals like yourself, at higher rates of course.

This flow of money allows companies to finance themselves and grow, people to buy a house by accessing a mortgage and small banks to be remunerated for lending money. The money so switch on the 'economy, creating value and wealth.

In the U.S. for example, and in this case for their central bank the Fed, the interest rate that banks charge in these cases during overnight loans is called the Federal Funds Rate.

This is the rate you hear about when the media talk about rising rates on the various economic news programs.

As you can see these rates definitely have an impact on the companies and people around you.

These rates affect the lives of the people and they are the underlying of any loan from any bank.

They affect mortgages, lines of credit and even bonds.

They are an important metric to monitor and keep an eye on in an advanced economy such as the West.

In fact, in the 2008 economic crisis, the Fed lowered interest rates significantly to help the overall economy recover.

So lower rates for banks are reflected in lower rates for businesses and people.

Companies have lower costs for a certain period of time and allows to have more employees, who have a salary and then expenses, so they boost the economy.

As you can see is a phenomenon that we could call circular.

Now, logically, in the event of rising rates any person with any debt will spend more for their debt and in the case of a company we would have higher business expenses and necessary cuts to be made to possible staff.

Now, read in this way, it seems that the solution to all the ills of business is to keep rates at rock bottom levels, but it should be noted that central banks must try to keep the economy sustainable, avoiding to depress it with high rates or set it on fire with the printing of money.

A system overexcited by unlimited money printing and low rates creates problems in the long and medium term.

An economy with a strong growth momentum, we will see a large demand for goods and services from citizen users.

Since the production of goods and services cannot be increased overnight and more people employed means more money spent in the market, this will result in a price increase called inflation.

If we want to explain inflation in a simplistic way, it is as if the value of money decreases or even collapses, decreasing economic well-being and eroding household savings.

We actually experience some inflation every year as central banks try to have an inflation level of 2% per year.

Understand that 2% per year is bearable, a 100% per year or per month is destructive.

So, understanding this risk, by raising interest rates and making loans more expensive, they are trying to cool down the economy, trying to balance it as best they can and lower inflation

Obviously there are short-term costs, but better than having an inflation like the Venezuelan one.

In fact, in the event of a rate hike, the effects will be felt by investors and consumers alike.

Consumer debts will become more expensive, such as home and car loans for variable rates while fixed rates will remain the same.

For investors, usually when rates rise the stock market sees a weaker performance.

This is because high rates make the operations of companies more expensive, more costs less revenues and therefore lower expectations in the stock market.

Bond prices will probably fall as new issues will have higher yields and will be more attractive and also the yields of deposit accounts will grow.

This leads us to be particularly careful how we expose ourselves to debt, teaching us another parameter to keep an eye on.

BONDS: the debt used to invest.

Why do bonds exist? How are they made?

Let's start from the beginning.

To grow a company, This company needs money and investments in itself and very often it happens that this financial need cannot be solved only through the cash created by sales. It therefore becomes necessary to access to loans.

The company may decide to turn to a bank or to the investing public, issuing debt in the form of bonds, so how do bonds works?

I give the money to the company and the company pays me annual interest on the amount until the bond matures.

Upon expiry of the bond, the company gives me back the value of the bond when I bought it.

The duration of the bonds varies, it is still a long-term investment that lasts years, from 5 to 30 years depending on the type of bond.

The return on a bond is varied and depends on the different areas and risks that are taken.

It may happen that the company goes into default and no money is returned to you.

In the event of an increase in risk, you are generally not obliged to keep the bond in your portfolio but you can also sell it on the market. This is also true if the bond has risen in price, you can take home a good profit.

Companies have less risk of default than individuals and the bonds considered safer are governative bonds.

Governments also issue debt to pay their expenses, and they do so by issuing bonds of different types, duration and yields.

Government bonds pay little but are considered risk-free because governments are not supposed to go bankrupt.

In theory, and then countries can always raise taxes to avoid default.

In case of default, however, the bonds are not all the same, in fact we have something called seniority ranking.

In the event of bankruptcy, the oldest bonds will be paid first by the liquidators.

The second safest category on the market are corporate bonds, of large stable national or multinational companies that are considered safe but are still companies that can fail, so these must pay higher annual returns to be attractive on the market.

The third category is High Yield Bonds, also called junk or very high risk bonds.

Some important things to keep in mind when buying bonds.

Bonds can be sold on the market, check the market value as it fluctuates based on previous and subsequent issues.

Newer bonds generally pay higher annual interest.

However, lower interest on newly issued bonds make older bonds with higher interest more attractive.

There are also bonds with negative value in terms of yield.

Always pay attention to the issuer's credit risk, if it increases or decreases because this affects the value of the bond but also the risk to which you expose yourself on the market.