What is a stock?

When we hear about financial markets and stock values on the news, we often pay attention only to the numbers and percentages, marveling at vigorous rises or destructive falls, but what do these numbers refer to when it comes to stocks?

What are stocks?

A stock, in finance, is a financial security representing a share in the ownership of a corporation. is a financial asset representing a percentage of ownership of a company.

So, as explained in the article on IPOs, companies sell their shares to recover funds. Kind of like what is done with bonds, but there are major differences. The only part in common is the need to drain funds for the company.

Since a stock indicates ownership of a piece of the company represented, the percentage you own depends on the number of those specific stocks you have in your portfolio.

the basic idea is quite simple

at the end of the year or at the close of the fiscal year, the money the company has made, after all expenses have been removed, is owned by the shareholders. These profits have to trickle down to the holders and have only two paths, dividends and capital growth

Assuming a profit of 10 million in the year just ended, the company may decide to split this figure in half. 5 million is distributed through dividends to shareholders while the other 5 million is reinvested into the company.

the company with this money can develop a new product or cheaper methods of production. this should lead to creating more profitability in the company and this has an effect on the price of the individual share, driving it up in price and allowing the small investor to sell it at a higher price.

Obviously as is easy to understand , having a preponderant amount of stock allows you to have a say in what the company does, being able to direct money management decisions. Shareholders must be happy.

Like any business sector, there are companies that are more or less solid and behave differently depending on the period. A health care company is different from one that makes cell phone apps.

Geographic location is also important, as a Western company will behave differently from one in a developing country.

Then there are two big definitions for stocks, namely growth stocks and value stocks

Growth stocks are stocks of young and small companies that have greater potential to grow in the future.

So-called value stocks are of established companies that have a history behind them and generally pay large dividends to shareholders.

Stock dividends are not to be considered the same as bond yields. In fact, dividends are a choice of the company to give money to its shareholders and not an obligation as in the case of bonds, an obligation that if not met leads to the default of the issuer.

IPO

If a company needs money, one way to avoid getting bogged down by going into debt, or further debt, is to become a Public Company or to going public offering shares of the company on the market.

These operations are called IPOs or initial public offering.

It is not exactly a very simple thing and indeed there are a lot of bureaucratic steps and tons of paperwork to fill out, however, for popular sentiment an IPO is a demonstration of business and also personal success on the part of the owner.

Let's go through an example on how to list on the U.S. market.

Step 1- Investment Banker

Investment Bankers are an individual or group of individuals, whom we can refer to for convenience as "early investors," who help the company informally raise initial capital. The goal is to recover as much capital as possible, with the banker doing all that follows to promote the IPO.

Step 2-documentation

A registration document with the SEC commission will then have to be drawn up.

this document will be devoted to all the details of the company's operation, to explain in detail the company's operations, management and its financing prior to the IPO transaction. An identity card will then have to be created for the financial authorities.

the SEC will obviously investigate to see whether there is true or false information in the document, only designed to defraud the public. The SEC must also understand whether the listing is feasible based on the financial stability of the Company, to protect investors.

If all goes well, a listing date is decided.

Step 3 - create a document for the public

the banker, after approval by the SEC, should create a document for the public with a description of the company, with its operations, current performance, and on projected future operations.

the document will be circulated into investment institutions and larger investors. This is just to begin to create interest

This does create the so-called indication of interest, to see how many stocks people are willing to buy and at what price

This is to make sure that the selling price of the stock is well calibrated when they are listed on the market, this also makes the allocation of the shares defined, that is, how many are sold

IPOs also suffer from the hype of the moment. Our company may be on the top level and be particularly fashionable, this will be reflected in its listing price. A big ask might be a problem for the average investor, and too high a price might not be a sensible purchase.

On the contrary, an IPO of a company that receives lukewarm or no feedback may also be postponed precisely because the forecast for market collection is really unsatisfactory.

IPOs, like any financial transaction, have inherent risks for the average investor. They need to be well researched and understood, especially if it makes sense to jump in at a moment of hype.

What is a currency?

Dollars, euros, pounds, marks, lire, sesterces and florins

Coins and their names have always been synonymous of wealth. But what is currency?

Today when we talk about currency, we think about the 10 dollars bill, but many of us think of ATM and credit cards. But currency is the fuel of every modern economy and is the unit of measure for the production of goods and services.

To understand the economic value of a good or service we use Currency as the unit of measure to make comparisons between different assets. We must then remember that broadly speaking when we have too much currency we suffer the phenomenon of 'inflation while when we have too little currency we suffer deflation. In theory.

It should be remembered that today's currency is issued by central banks against the transfer of collateral i.e. government bonds, so this currency is borrowed or rather created as loan, which generates debt.

Thousands of years ago, before the invention of currency, the 'economy was based on barter, which, however, was not an efficient system given the various things to be bartered. If I own 3 eggs and I need a cow for my farm, well barter becomes a system that makes at least one party interested in the exchange unhappy. The exchange becomes impossible and I will never get the cow I need. And the eggs rot.

Now given the impossibility of applying the system all exchanges, what we call "currency" was invented to solve every problem. With X number of coins I can go to my friend and get the cow I am interested in, so the same coins can be used by my friend to pay the worker to fix his farm that is falling apart.

Coins also, in 'antiquity but also until recently, had an intrinsic value determined by the value of gold and silver used for minting.

Coins, however, are a difficult commodity to carry around in large quantities; they can be stolen or lost. Buying a loaf of bread or a palace, requires a large difference in the quantity of coins. To overcome these problems, checks were born, which later turned into today's banknotes.

We have condensed the story as much as possible for ease of understanding.

Each banknote guaranteed the existence of its gold value at the issuer's depository.

in 1944, at the height of World War II, the monetary system was changed at Bretton Woods, and the only currency convertible into gold becomes the U.S. dollar with all other currencies pegged to it

in 1971 nixon abandoned gold convertibility for the dollar to avoid default because US was involved in the Vietnam War. On that day the fiat currency was born, or perhaps it would be better to say returned to the stage of history, whose value is given by trust in the 'authority that imposes its use, thus the government that issues it.

there are no more limits in the creation of money, being able to print as much currency as one wants and needs since the currency is created by the central bank of a country, in this case if we are talking about Europe , by the ECB.

In the history of our planet and of our civilization, kings, sovereigns and emperors had the ability to create the currency, and then this ability moved on to lordships and governments , and now end up with central banks that are private entities.

To date, the value of the currency is given by the international exchanges that take place between the various states, which implies considering the strength of the various economies as well.An increase in the value of a country's currency will make the purchase of its goods and services abroad, by a foreign citizen with lower value currency more difficult. The higher the value of the currency, the higher the price of goods that will be exported. One of the unfair activities you can do is to artificially keep the value of your currency low to increase exports by going to devalue it. And yes I am talking about you, China!

This is where Bitcoin comes in, which is a "currency" that we can describe as special. In fact, nothing like it has ever been created in the history of 'man, while the economic history books are full of fiat currency experiments that failed. Go look at what happened a few decades before the French Revolution....

In fact bitcoin possesses two characteristics that are unique compared to fiat currency, namely its decentralization and its deflationary nature.

No one controls the protocol nor can anyone change its characteristics by issuing more or less coin than those decided in the protocol. The protocol can be modified but all users must agree to the modification.

In the long run, the deflative nature of bitcoin makes it an excellent tool for long-term savings.

Brief history of the PetroDollar

Today we are going to give you a brief history of the monetary system we live in, better known as the PetroDollar system. Simple explanation to understand a little better the world we are immersed in and we take for granted.

The PetroDollar system is created as all commodities on the planet to be bought and sold in U.S. dollars, which is the currency printed by the United States of America.

To understand why we live in this sistem, we must go back in time to the early 1940s.

The world was involved into World War II, fighting was going on almost everywhere, and the Allies were about to attack German-occupied territories. The most industrialized and powerful country on the planet at that time was the United States, ousting the United Kingdom from its throne as the world leader and dominant empire on the planet.

In 1944, with the Bretton Woods agreements, it is decreed that the dollar will be the world currency pegged to gold when the war is over and consequently all other currencies will be pegged to the U.S. dollar.

With the war over,we had a period of prosperity and economic revival. The fabulous 1950s.

Years go by, however, and we come to the 1970s. The world is divided into two blocks, the Western block versus the Soviet block countries, and all over the world there are more or less heated skirmishes and clashes.

The hottest place on the planet is Vietnam, which sees massive intervention by the United States in open warfare to prevent the Soviet threat from taking over all of Southeast Asia. But this massive effort costs dearly, and the U.S. spends billions of dollars, printing and printing.

Nixon on August 15, 1971, in a surprise move, eliminates gold convertibility of the dollar. Of course it was a "temporary" measure to get out of the crisis. But the United States remains the country in charge of the planet, and our economic planet needs a specific raw material to make the economy work. Oil.

In 1973 Saudi Arabia and the United States agreed to sell oil on the world market exclusively in U.S. dollars. This supports the world demand for dollars since any country wishing to buy oil will have to exchange its currency for dollars and then buy the oil. This system then applies to all raw materials needed for a developed industry. This is also a way of geopolitics control in addition to the presence of military bases in various countries.

The U.S. presence in Saudi Arabia protects the Saudi royal house and the country from all kinds of aggression, since not all countries in the world are aligned with Washington's policy or wish to sell their oil under this system.

The greater the demand for oil, the greater the demand for dollars in the world becomes.

It must be said that some countries such as China and Russia are trying or have succeeded in getting out of this system, but we are talking expressly about the major competitors to the world leadership of the planet.

The Scam List - A guide to avoid scam - Part 6

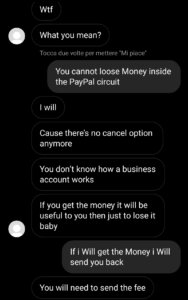

Instagram and Paypal scam

This Scam cost us $10.

Not because we didn't realize it was a scam, but only because the situation had become so funny and absurd that we wanted to see how it would end.

Let's start from the beginning. Like many of you, I have an account on instagram where I rarely post content that makes me and my friends laugh. It is a very normal account that has very few followers and i know all ot them.

I get a message from a stranger who wants to buy pictures of my feet from me. For the incredible sum of $1,500. I am a boy but he thinks I am a girl and I can also understand the kink but the amount is too high. Curiosity was stronger than me and I let him write.

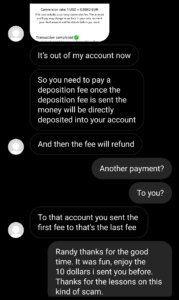

Our friend, let's call him by his nickname Randy, convinces me that he is a serious buyer and wants to pay immediately, despite me buying time by promising him photos and payment a few days later.

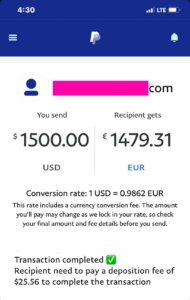

He starts insisting that he wants my paypal address, after a couple of hours I show him my address and Randy sends me a screenshot of Paypal where there is a money transfer of $1500. The strange thing is that underneathm there is a note where it says that I, the recipient, have to pay a $10 fee to receive the money.

The screen is clearly an edited screenshot of a real money transfer, not yet formalized, with the fee part added.

I start asking more about the fee only to see the scammer's reaction. Our friend Randy began storming me with messages, telling me that now that I had the money in the account I was no longer responding and that I was the scammer. The fee , according to him, was motivated by the fact that he had a business account and, because of this fact, Paypal worked this way. And this was not true.

Plus The push to me to pay the $10 was very strong. Here we have another element to pay attention to.

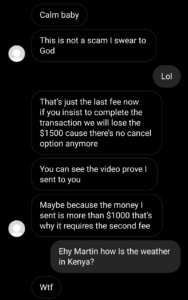

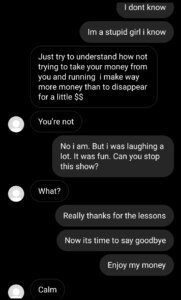

After a while I decide to send him this $10, obviously knowing I'm going to throw it away. I send the $10, as Randy tells me, with the "send to a friend" solution (so without the possibility of being able to get it back) and he asks me for a screenshot.

Randy disappears for half an hour, probably he moves the $10 into another account, and in the meantime he prepares another screenshot for me. In fact, after a short time I get another screenshot of the payment but now with another 25 dollar fee.

It becomes apparent that the vicious cycle becomes unstoppable, and that the payment fees will rise in value exponentially. That said, I declined payment and Randy in despair accused me of trying to make him lose his $1500. Another impossible thing, since if the money was in the Paypal loop, it would go back to the sending party.

That said, I ended it all by thanking Randy for the lesson and the fun.

To recap, as you can see, this scam is based on ignorance of how Paypal works, absurd excuses, and the haste and pressure created by the scammer on the victim. If you have used Paypal you know that any fees are charged to the payer, not the recipient. Just the initial situation alone was so absurd that it could only be a scam.

The next day we got the exact same scam again, from another user who always wanted to buy pictures of my feet (I still don't understand why). The pattern was the same, the only difference being that in this case the payment fee was justified by the fact that the paypal account was in cryptocurrency and not USD.

This is all fantastic

Ethereum

Vitalik Buterin has given to the world one of the platforms with one of the biggest potentials on the planet. Ethereum has a very interesting future ahead of it.

Ethereum, whose currency is called Eth, is not only on par with btc a currency for exchanging value, but it is a decentralized platform for creating complex applications. In fact, the goal of ethereum is to decentralize the Internet from the network giants of today.

Ethereum is a decentralized platform for the creation and peer-to-peer publication of smart contracts, or in short, contracts that are self-executing and self-fulfilling. The applications of these contracts are and will be of an enormous number and will cover Gaming and gambling, various contracts, certifications, voting, real estate records and much more.

Even the famous ICOs are actually very simple smart contracts tied to the written code base. This code makes the contract immutable once deployed on the network and after blockchain approval.

Complicated smart contracts have a very high inherent level of difficulty and a huge need for security. You have to create perfect programming and be sure that the contract does only what the programmer has decided. Always remember that Code is Law.

The principle behind Ethereum is that since it is a decentralized platform for program development, anyone can create a program that cannot be controlled by any person or group and that program will run on Eth's network. With a little study of Solidity, all intermediaries can be eliminated and developers can work directly on the Blockchain.

Ethereum was launched in July 2015 and has since become the second largest cryptocurrency by capitalization. Its potential is extremely interesting and deserves to be followed .

A lot of applications are being developed on the ethereum network, from DEFI to NFT tokens to decentralized exchanges that are used to exchange tokens of different types, on the same network, eliminating the trust problem of a centralized exchange.

Ethereum's ease of programming has meant that thousands of other coins, which we can call tokens or altcoins depending on the situation, have sprung up on its network.

Tokens can be defined as the tokens for slot machine, and there are different types of crypto tokens. If we take our cue from Finma, the Swiss regulator, we can define them into 3 categories.

- payment tokens not linked to other functions i.e. Bitcoin, Ethereum, Litecoin. These are real coins, born for value exchange.

- utility tokens that serve a single platform or digital service such as Ripple's XRP, or Binance's BNB, and can be exchanged outside their native platform.

- Investment tokens, which, on the other hand, represent asset values, such as shares in real assets, companies, revenues, or the right to dividends or interest payments. These tokens should be considered in relation to their economic function, in a similar way to shares or corporate bonds, or a derivative financial instrument.

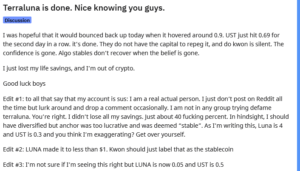

Death and Market

This article is purely an expression of my personal thoughts and a series of experiences that have been part of my life. These are thoughts put in order after seeing some online posts.

Boom.

Market crash.

Anxiety, panic, pain. Account zeroed out.

No prospects for the future. Our hopes are dead.

It's time to follow our hopes.

No. Absolutely NO.

There is no financial reason big enough for a small investor to end his or her life. The pain for this choice is much, much greater than anything else.

In my life I have met friends, with whom I shared many good times, who unfortunately years later, for healthy reasons, decided to end their lives.

I understand their point of view. They were facing a destructive time in their lives, the future was marked by a certain physical and mental decline that would reduce them to nothing.

Their choice was drastic, with a lot of depression and pain that they were unable to sustain.

However, I also saw that their pain pass to their families. Destroyed by sudden loss, by such great but unperceived distress. That hurt that afflicted my friends passed into the souls of their parents, who throughout the rest of their lives will wonder why and if they ever could have done anything different to change this horrible ending.

Whenever I see articles about some crash that leads to suicides I think of my friends' parents. And I reflexively think of the parents or families of those who have killed themselves for making financial mistakes. And I think of what they will go through in the future, the wave of grief and despair they will have to experience and endure.

There are no good reasons for a family man who has made financial mistakes to kill himself.

The most important thing is to try to be careful and vigilant and not put ourselves in conditions that corner us and that can be a source of despair and family destruction.

If we take one of the latest examples in the crypto world, namely the Terra crash, we see how part of the public staked everything on this assett, convinced that it would quickly lead them to instant wealth.

You know very well that this is not how it works, wealth is not a one moment thing, it is a long and difficult path. Putting all your eggs in one basket is self-destructive to your wallet.

I know the rush to be rich, I know the desire to possess, I know the thirst for money. These are all desires that only destroy who we are and lead us to make mistakes, sometimes huge ones that could sink us for good.

We have to control our psyche, control our desires and reason wisely.

There is always only one solution.

Risk control. Always at all times.

Emotion control.

Reality control.

Understanding that achieving wealth is a path and not a one-time event in our lives.

Psychology, money and divorce

I was talking some time ago with a psychologist friend about how she was working more and more with couples or individuals who were going through the end of their marriage or were close to divorce. In the end, I realized that the main reasons that lead people to divorce are basically three and they are all issues related to Sex, Money, and Family. All issues that are mixed into a gigantic problem that destroys even the most loving couples.

Now I fully understand my friend's words and the situations she described. I cannot talk about family problems because every family is made differently, but money is the same for everyone. So is our reproductive system.

Managing the family budget is something delicate. Two people, with two different spending predispositions, come together wanting to start a family. These same people will have to profitably manage the money they themselves bring home.

The point is all about "managing profitably."

A person may be more predisposed to saving or to squandering. Going from the extreme of saving every penny to the other extreme of spending it all to the point of being left with bank account in deep red at the end of the month.

The issue of having a couple formed by the two extremes in the long run goes to create enormous tensions. As always, virtue lies in the middle, but the propensity to save is an innate quality and a behavior taught by parents.

In addition to how to spend money on everyday things, then go the choices and discussions for the long-term expenses that are considered important, namely house, car, and investments.

Things like changing the car every 2 or 3 years, looking for a beach house or deciding where to take the darn vacations.

Money is often an issue in every family, especially if one or more children are also involved. Making ends meet is crucial, as is ensuring an adequate amount in the children's future. If you want them to be educated in the right private school, you will need to have the right amount in the account.

Saving something is always important; making your wife or husband happy is equally so. But economic problems and the anxieties produced by these, in times of economic slowdown, become more and more acute. Anxieties and problems that are always reflected in the behavior of he or she in the family who administers and makes ends meet.

Think about it for a moment, if you are very worried about your economic situation, this worry will follow you everywhere, even during your quality time with your partner. Time that will no longer become quality time until it becomes nonexistent.

And after some time your partner will go looking for this quality time somewhere else. And you will end up being the second tier partner and usually end up breaking up.

Have you seen that loop? Money problems that become sex problems that become family problems. Complete destruction.

Of course, the description is overly simplistic. One cannot describe in totality the issues in a relationship and the various facets that each of us has that change behavior within a couple, but in broad strokes this example is a good picture of what happens.

What to do to avoid this?

When you have economic anxieties and issues, talk to your partner about it. He or she needs to be aware of the problem and understand why you are behaving a certain way. It may not be the easiest choice, but at least he will know that he needs to start cutting unnecessary expenses.

Explaining economic mistakes and errors is bad. Our egos will always suffer but heck, reality is reality and if you want to solve problems you must first accept that they exist. Dealing with problems and stress together can prevent 'misunderstandings and destructive or self-destructive behavior.

Having an emergency fund, large enough for a few months of survival, is always a good thing, and those who do not have it always take a risk that I find exaggerated.

A little available liquidity always makes sense. Especially now.

The Scam List - A guide to avoid scam - Part 3

Pump and Dump Scheme

The same scam of pump and dump scheme is used in some telegram groups.

In fact, there are telegram groups that are dedicated only to the pump and dump of some low liquidity altcoins and on exchanges that are not of the highest order. In these groups, the pump organizer will indicate a coin with a surprise message about the group. At the same time, this coin on the indicated exchange will have a sudden rise in price, even in the order of 50 or 100 percent. This climb will be very short, we are talking about a time ranging from 2 to 5 minutes, and then the price will drop again due to lack of buyers. In fact, the system is fraudulent because the organizer of the group in the period preceding the message bought up coins at a very low price. When he posts the message on the group, he puts purchase prices for a few coins at very high prices, making other users of the group follow him in their purchases as well. Immediately after, the same organizer of the group begins to sell the coins bought at low prices. The pump runs out when the organizer has run out of coins to sell and the price immediately collapses due to lack of buyers. Most of those who have been a little slower than the other users of the group, but who have bought at an exaggerated price, remain screwed by the climb and with the coins in their wallet.

Trading Bot scam.

A trading bot scam is simply a website that sells a trading system or bot, which most likely does not exist, at a not particularly high price. This revolutionary and innovative software is sold on these sites, which through an incredible and unsurpassed artificial intelligence, allows the user to trade on various assets and to have unthinkable earnings. All while spending ridiculous amounts like 200 or 300 euros. These trading bots are promoted with fake sites and portals, where there are fake testimonials, with fake investors and even with fake testimonials taken from the world of VIPs. It's all fake, only the money you will loose is real.

These sites are complete scams, because given the small amount requested per user, upon reaching a figure such as 500 thousand 1 million euros, the site will be closed and the money will disappear on accounts abroad or in offshore banks. The small amount at stake means that none of the scammers spend money and time on complaints and lawyers given the costs of justice.

These trading bots cannot exist, both because the figures requested from users are too low, and because each financial asset has its own peculiarities and therefore a single bot would never be calibrated to work at its best. In this case the ideal victim is the one who knows nothing about finance and trading, wants to earn quickly without effort and without studying. A minimum knowledge of the environment would be enough to understand that these systems are only used to enrich those who create and advertise them.

Any information on those sites is created for the sole purpose of enticing people and making them fall into a trap, sometimes prompting them to spend more money to make these non-existent programs work even better.

Fake Ledgers

Another scam that has been happening lately concerns hardware wallets bought on second-hand markets such as ebay or passed off as new on sites of unidentified origin. The user buys the wallet on the site and if he sees it delivered to his home. Inside the box, he already finds a seed phrase, with clear instructions that this phrase is the one to use with this wallet. A user with a minimum of experience and who read our blog knows that this is a security flaw. In this case, the experienced user would format the wallet and create another new one of which only he has a password and seed.

The inexperienced user, on the other hand, uses the wallet directly with the phrase indicated by the seller. In this case, the scam seller is aware of the sentence and monitors the wallet. When the wallet is filled with some bitcoins or other coins, the seller empties it by stealing the funds from the inexperienced user.

Be careful when buying hardware wallets, if possible only buy them new and always from official sites. In the case of a used one, always create a new phrase and a new wallet.

Learn more about scam in Part 4 here.

The Scam List - A guide to avoid scam - Part 2

The ransom email

You open your mailbox and you find a strange email, from an unknown sender, calling you by name and threatening to make public videos or photos stolen from your webcam, of you in particular and spicy acts or situations. Some emails even have weird allusions to your most hidden perversions or your weird sexual tastes. Don't panic. It's just a scam.

In the email, the sender threatens to put this hot material online and send it to all your contacts, letting you know that he has infected your PC and that he has stolen your email address book data. In 48 hours you will have to pay a sum in bitcoin or other cryptocurrencies, to an address in the email.

Behind these emails there are scammers. in almost all cases your pc has not been infected nor has it been hacked. They simply send emails using databases stolen from the big providers and try to fish in the pile, given the very high amount of visits on the various porn sites in the world.

You may find attachments in these emails, obviously do not download or install anything but simply trash them.

Ponzi scheme

The Ponzi scheme derives its name from its founder, Carlo Ponzi, an Italian immigrant to the United States who, between the 20s and 30s of the twentieth century, invented this type of fraud, probably the biggest contribution made by Italy to the world of fraud. Ponzi is in the hall of fame of world scammers.

The Ponzi scheme is based on the promise of earnings in an investment that has well above average earnings in a very tight time frame. In effect, this investment is returned with the negotiated sum of earnings, making the public believe that the investment system really works. Word spreads and by word of mouth other "investors" are pushed to invest. To push even more to raise money, those who bring other people receive bonuses, cash prizes and higher earning percentages. Money continues to be distributed in cascades to the first who entered the investment, fomenting the perception of the functioning of the investment system.

The scheme is interrupted only when the first in the chain runs away with the bag, or if the refund requests exceed the new payments entrance.

This system is based solely on greed and the desire to make easy money quickly. The financial ignorance of the people, combined with the thirst for money, makes this scam working.

in fact, the product to sell is perfect but it does not exist and the only real push is to become a promoter to bring in as many people as possible to increase their personal earnings with bonuses for adding new followers

We must try not to be greedy and to understand that quick and easy money does not exist. If they offer you a similar system, where the product is empty and you have to bring in acquaintances, you now know that it is a Ponzi scheme. Always do analysis on the company and the products offered

Guaranteed annuities are a different type of scam scheme, which are based on guaranteed returns with an impossible percentage in a very short time

For example, we have had experience with platforms that promised 10 percent revenue per day by simply downloading a small program or sending ethereums to some address.

The most blatant promised to double their capital in a month

These are absolutely fraudulent figures that have no way of existing.

The False ICOs pump and dump group

The scams also can happen during an ICO with the creation of a scam coins

Let's recap what an ICO is.

ICO or Initial Coin Offering, is the initial offer of new tokens generally on the Ethereum platform. When a certain sum of Ethereum is sent to a defined address, the smart contract inherent in that address will send us the number of tokens defined for each ethereum sent to the sending address.

So participating in an ICO for an average user is very simple. It is just a matter of sending ethereum and seeing the corresponding tokens appear on the wallet.

The sending address of the ethereums is made clear on the official website of the crypto project, with all the information to read up on, the road map and the white paper.

As you can imagine, however, there are many weaknesses in this structure. Here are some examples that actually happened in the real world.

First of all, it happened that a hacker changed the ethereum address marked on the official website of the company that made the ICO. So the funds sent did not end up in the start-up wallet, but in the hacker's wallet. These ethereums have been lost forever, because as you remember, there is no way to cancel transactions on the blockchain.

Another scam method applied was to create a clone site, identical in all aspect to the official site but with a different web address. The site had the only difference in the ethereum sending address, this referred to a wallet owned by the scammers. Also in this case, the ethereum sent were lost. An example above all, the fake scam sites that pretended to be the Telegram ICO.

Third method, the similar name. It happened that a Blockchain project was copied into the idea and a website was created with similar graphics but with a slightly different but very similar name. In this case, the careless investor would have confused the two projects and therefore would have sent the ethereums to the pirate site.

Another scam method using ICOs was the creation of ICOs for the sole purpose of putting scam tokens on the market that were used exclusively to create the pump and dump phenomenon on exchanges.

The situation is the following. The scam start-up presents you with a fantastic project that solves a small technological problem and promises a short-term development in other markets. The project appears solid and with interesting long term vision. This makes the ICO and the Ethereum collection a success. However, the team-owned tokens are not locked, so the team is free to sell on the market. Generally hype is created about the project and pushes for a sharp rise in the price on exchanges. This is the pump phase. As the price rises, the team without being noticed sells their tokens until they run out. At this point the dump phase takes place, where the project is abandoned and the price on the market collapses, the tokens without real use and value remain in the hands of the scammed investors and the creators of the start-up run away with the funds.

Learn more about scam in Part 3 here.