Growth vs Value Investing

In the article “what is a stock”, we mentioned growth stocks and value stocks. This differentiation applies to two different approaches to allocate money in the market, even creating two competing schools of thought.

When we talk about growth, we are defining a quick, fast, nervous growth approach, popular in today's start-ups such as Uber, Tesla, and all the other New Economy companies.

The value approach, in contrast, is based on slow steady growth. More on a kind of Warren Buffet vision.

These two approaches, so different from each other, can obviously be divided into different strategies or be mixed in the average investor's portfolio. The important thing is to grow our capital.

We can define the investor's most suitable approach based on 3 characteristics:

1 the growth of the company underlying the stock.

In this case, our focus will be directed at the company's economic growth and returns. This is a Growth approach when these characteristics outperform other companies in the same market or beat the market itself. It is the obsessive search for the new Apple to revolutionize the industry.

Investors look for companies with a couple of years of rapid growth, and these companies will in most cases be smaller and younger and leaner than their competitors.

In contrast, Value investors are not interested in these mirabulous performances but aim for more mature and stable companies with slower growths.

2 Valuing the 'stock

To be a value investor is to be a bargain hunter, buying low for stocks of higher intrinsic value than the market now prices. In the mindset of the value investor, you don't buy stocks just because they are cheap but because there is a study and a search for value behind them.

Growth stocks tend to be much more expensive, but the 'investor will be pay this price because he expects exponential upside.

3 price volatility

growth stocks in most cases suffer from higher volatility than value stocks. This is because Growth stocks have a higher inherent risk given the fundamentals of start-up companies that are not yet established.

the growth approach is a riskier approach, although it may be the one that pays the most if you are buying a company that will have exponential growth over the years

growth stocks are usually sold and bought based on promises. Promises of growth, turnover, and market position. But promises are not always kept.

the value approach is more time-consuming and much more boring, with low volatility and little market excitement.

what is the best approach? depends on the period you are considering, how much risk you are willing to expose yourself to, and what kind of companies you are analyzing. A mix of the two methods might be the right choice, while a single growth approach in a specific sector that is growing is risky but in principle profitable. Hopefully.

What is a stock?

When we hear about financial markets and stock values on the news, we often pay attention only to the numbers and percentages, marveling at vigorous rises or destructive falls, but what do these numbers refer to when it comes to stocks?

What are stocks?

A stock, in finance, is a financial security representing a share in the ownership of a corporation. is a financial asset representing a percentage of ownership of a company.

So, as explained in the article on IPOs, companies sell their shares to recover funds. Kind of like what is done with bonds, but there are major differences. The only part in common is the need to drain funds for the company.

Since a stock indicates ownership of a piece of the company represented, the percentage you own depends on the number of those specific stocks you have in your portfolio.

the basic idea is quite simple

at the end of the year or at the close of the fiscal year, the money the company has made, after all expenses have been removed, is owned by the shareholders. These profits have to trickle down to the holders and have only two paths, dividends and capital growth

Assuming a profit of 10 million in the year just ended, the company may decide to split this figure in half. 5 million is distributed through dividends to shareholders while the other 5 million is reinvested into the company.

the company with this money can develop a new product or cheaper methods of production. this should lead to creating more profitability in the company and this has an effect on the price of the individual share, driving it up in price and allowing the small investor to sell it at a higher price.

Obviously as is easy to understand , having a preponderant amount of stock allows you to have a say in what the company does, being able to direct money management decisions. Shareholders must be happy.

Like any business sector, there are companies that are more or less solid and behave differently depending on the period. A health care company is different from one that makes cell phone apps.

Geographic location is also important, as a Western company will behave differently from one in a developing country.

Then there are two big definitions for stocks, namely growth stocks and value stocks

Growth stocks are stocks of young and small companies that have greater potential to grow in the future.

So-called value stocks are of established companies that have a history behind them and generally pay large dividends to shareholders.

Stock dividends are not to be considered the same as bond yields. In fact, dividends are a choice of the company to give money to its shareholders and not an obligation as in the case of bonds, an obligation that if not met leads to the default of the issuer.

XRP and Ripple

There is a coin in the cryptocurrency world that is considered a cryptocurrency when in fact it is not.

We are talking about XRP, created by the company Ripple. In common parlance XRP and Ripple have become synonymous, but the token's only name is XRP. This coin was not created with the idea of being a more functional alternative to Bitcoin, but to be a tool in the hands of the banking world by creating an alternative system to Swift.

XRP is not a real cryptocurrency because it is not totally decentralized.

In fact, Ripple began in 2012 as a system for transferring funds through a network for currency exchanges. In September 2018, Ripple was the second largest coin in the cryptocurrency market by market capitalization.

Ripple controls and manages XRP and has agreements with banks around the world. its code is open source and the value of the coin is affected by the value that is also assigned to the company.

Ripple was created solely to replace old systems such as swift, western union and moneygram with a cheaper system. Not all banks are connected to each other in the world with a single system. This forces banks to switch between different intermediaries in different countries, with long time and big cost for every transactions.

XRP is not created to be a store of value or to make transactions between economic actors in the real market but as a technical tool for specific banking actors or Payment Systems, companies, corporations, currency exchanges.

Because of its characteristics, Xrp cannot be mined but is a pre-mined currency. XRP is fast and scalable, in fact transactions in XRP take about 4 seconds versus 5-10 minutes for btc

XRP's wallet works with a minimum deposit of 20 XRP, an sistem created to avoid inordinate growth of accounts on its network for the sole purpose of clogging up the network and slowing it down.

The token is divisible up to 6 digits after zeros and some XRPs are destroyed after each operation, another system to protect the network. In the event of an attack, with thousands of useless transactions for the sole purpose of slowing down network, this system drains the accounts of the addresses that create the transactions.

Ripple's protocol is called rtxp Ripple Transaction Protocol and consists of pcs called validators that manage the network with their shared ledgers. Companies wishing to use Ripple's network must use gateways, which are points managed by banks and useful to those outside the network.

Ripple Labs was created only to offer banks various types of products, in fact RXTP is open source but the ripple products offered to banks are not and are created and developed only by ripple labs.

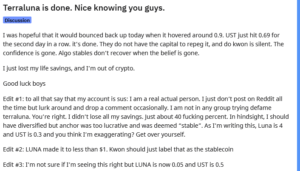

Death and Market

This article is purely an expression of my personal thoughts and a series of experiences that have been part of my life. These are thoughts put in order after seeing some online posts.

Boom.

Market crash.

Anxiety, panic, pain. Account zeroed out.

No prospects for the future. Our hopes are dead.

It's time to follow our hopes.

No. Absolutely NO.

There is no financial reason big enough for a small investor to end his or her life. The pain for this choice is much, much greater than anything else.

In my life I have met friends, with whom I shared many good times, who unfortunately years later, for healthy reasons, decided to end their lives.

I understand their point of view. They were facing a destructive time in their lives, the future was marked by a certain physical and mental decline that would reduce them to nothing.

Their choice was drastic, with a lot of depression and pain that they were unable to sustain.

However, I also saw that their pain pass to their families. Destroyed by sudden loss, by such great but unperceived distress. That hurt that afflicted my friends passed into the souls of their parents, who throughout the rest of their lives will wonder why and if they ever could have done anything different to change this horrible ending.

Whenever I see articles about some crash that leads to suicides I think of my friends' parents. And I reflexively think of the parents or families of those who have killed themselves for making financial mistakes. And I think of what they will go through in the future, the wave of grief and despair they will have to experience and endure.

There are no good reasons for a family man who has made financial mistakes to kill himself.

The most important thing is to try to be careful and vigilant and not put ourselves in conditions that corner us and that can be a source of despair and family destruction.

If we take one of the latest examples in the crypto world, namely the Terra crash, we see how part of the public staked everything on this assett, convinced that it would quickly lead them to instant wealth.

You know very well that this is not how it works, wealth is not a one moment thing, it is a long and difficult path. Putting all your eggs in one basket is self-destructive to your wallet.

I know the rush to be rich, I know the desire to possess, I know the thirst for money. These are all desires that only destroy who we are and lead us to make mistakes, sometimes huge ones that could sink us for good.

We have to control our psyche, control our desires and reason wisely.

There is always only one solution.

Risk control. Always at all times.

Emotion control.

Reality control.

Understanding that achieving wealth is a path and not a one-time event in our lives.

The Scam List - A guide to avoid scam - Part 5

- Links and emails

Our mailbox can be a source of trouble if we use it wrong and without thinking too much about it.

It's true that we receive a lot of emails but we must always be careful.

It often happens to be prey to waves of phishing mails.

Now you should always check what you receive.

If you get an email that you don't recognize with some strange link in it, throw it away.

I have personally received clone mails of the electricity bill, which invited me to pay small amounts on different bank accounts and with different methods from the previous bills.

I have also received clone mails from banks, not only the one where I have the account, but also others with which I have never had to do, inviting me to login directly from the mail or sending me to an external link to login.

And then steal my credentials to access my account.

Same exact scam procedure to steal my credentials, but with the excuse of a contest in which I could win a dream vacation and an iphone.

Always check what you are doing with these emails and never ever enter your credentials or click on the links inside.

In addition to sending you on clone sites can lead you to download malware that infect your PC and steal your sensitive data.

Protect yourself at all times.

- Guru

You often see them in youtube ads or on instagram.

They have the secret, the magic formula and they want to reveal it to you.

They read 200 books a week, live in huge villas with 50 bedrooms and have garages full of Ferraris, Lamborghinis and Bentleys.

They are the self-made millionaires who want your personal growth and who want to see you rich.

OK

All beautiful, but who the heck is this guy?

And if he has all this money why does he want to sell me a course or a book?

Now, let's get this straight, I have nothing against wealthy people who have large assets and who make their knowledge available to everyone, but these people in most cases are selling you half scams. It is hard to tell who is really good from the one who wants to scam you.

These kinds of scams appeal to those who want to make money quickly, effortlessly, at most by reading some booklet or with a magic formula.

The world of social media has made the presence of these kinds of investment gurus soar, who have all the answers and know it all.

In most cases they aim to sell a course, a book or an investment method, all seasoned with a social image of success wrapped in luxury and opulence.

The story is very similar, it starts from a childhood without prospects up to an adolescence where non-stop work and study reward up to have a stratospheric bank account, with companies around the world that bill as if there was no tomorrow and contacts with all the big celebrities in the world.

Now, we may or may not believe these gurus, maybe they are right, maybe they are really good and they will make you a lot of money.

But those of us who want to avoid risk have a few research methods.

The first thing to do is not to fall in love with what they sell us but to analyze what they propose.

Done that, if it all seems too good to be true, well we have already understood that it is a scam.

To go deeper we can start to scan google and the various social. If this guru is so good, he will have left traces around the network, with all his companies operating in the world.

Linkedin is already a showcase to start with. After that we start looking for reviews of his work on various forums or reddit.

If he has so much success and so many followers, surely you will find recent reviews of his work where you will be explained well what he does and what he teaches.

Remember that some reviews can be deleted, so do a thorough search.

Now based on the results you can decide whether to listen to these people or leave them where they are, having a laugh watching their videos with models and rented lamborghinis.

- Scammers on Telegram

Today we talk about telegram and people who contact us trying to scam us.

Typically when we are contacted by people totally unknown on telegram, 99 out of 100 we are in the presence of a scammer, who perhaps has even stolen the identity of someone famous in the environment to give a tone of reality.

Now somehow the scammer has to make sure that we send him our money.

What are the methods?

One method is to pose as a big trader or investor, with a big opportunity in his hands and he proposes it to you.

He proposes it to a perfect stranger on telegram. And already here we should block it.

But let's go on, obviously he gives you information to seem credible and to make you trust him, plus he will try to get information from you to use against you. This is a subtle psychological game played against you and your wallet.

First of all, if he sends you files or links, don't download anything.

You don't know if there is malware or anything else.

He will easily ask you for money and try to put urgency on you because this opportunity is getting away, you have to hurry and it is the purchase of your life.

In case you fall into the trap, say goodbye to your funds.

Nothing will be given to you in return, you have decided to send this money to an unknown address.

No one can ever come to your rescue.

A variant of this method is to be contacted by someone who was, like us, in a chat room of some crypto project that had a price collapse or cheated its investors. This guy who contacts us pretends to be one of the founders of the group and wants to help us recover our money spent on this project.

And here he starts to ask us for personal information and then ask us for money to recover our money.

Money that obviously will be gone because this is nothing but another scammer who wants to take advantage of our negative psychological condition of the moment.

We will do anything to get our money back, even trust the first person who offers to help us.

And we would lose more money.

A more elaborate version of the first scam method is the so-called boiler room, a term for an improper negotiating tactic done in secret, in some company's boiler room. Who would make serious and honest contracts in a boiler room.

However, the scam usually works like this.

You are contacted by someone from some big company with big investors behind them.

They have everything set up right, the website is nice and accurate, and maybe they even have a real office in some coworking space.

They present themselves in the right way and offer you a great deal, yet another opportunity of a lifetime.

You are not convinced and maybe after a while you talk in chat you go to meet them in person, and when you meet them they offer you a coffee, all nice and in this case you trust them, because they have done things right, they are serious because they are well dressed and speak well, they don't have tattoos and are freshly shaved, they have an address and a hot secretary.

And you fall for the scam by giving them money you'll never see again.

Because they, with a huge sense of urgency have promised you huge profits.

Profits that you will never see as your money.

Now there are some things in common in these stories:

lack of transparency on the part of those who contact you

an offer too good to be true

sales tactics that put pressure on you

an urgent request for money

Now, remember that you have no idea who is on the other end. Are you really sure they are looking out for your best interest?

The Scam List - A guide to avoid scam - Part 4

- Nigerian SCAM

You are quietly at your computer while working or chilling and an email arrives from an unknown address.

You open it and read the story of this Nigerian prince in trouble somewhere in Africa or Europe, who ran out of money and is asking you for financial help.

In return, he promises you in the email that he will send you 10 or 20 times the agreed sum once he gets home.

Isn't it a bit strange as a story?

We also have another variant, that of the Nigerian astronaut.

Abandoned in space by his agency, a super sad guy that just only wants to go home.

From Space.

Probably in the ISS.

Of course, because space agencies spend millions of dollars to send scientists into space to do research and then halfway decide to abandon them, no one knows where, inside some random shuttles.

Or inside the Space Station, which is known to be so large and spacious that it has room for random people.

Another variation we have seen is the story of the prisoner.

Our writer asks us for help because he is being held prisoner in some village in Afrika or Arabia, in the hands of terrorists or criminals.

Our new friend has managed to get his cell phone to work and he promises you that if you send him money to pay the ransom he will give you all his jewels.

In fact,is full of criminals and terrorists who leave you the cell phone with which to write emails around the world, especially to do crowfunding to pay ransoms of people you have never seen.

And they write to you, because they know that you are so much good hearted that you will help them.

Now it is clear that they are scams if you think about it for a moment.

The stories are quite ridiculous and imaginative that with careful analysis they also make you laugh.

Don't be fooled.

Trash the emails and have a laugh.

- Ramson mail

Ramson mails are emails arriving from unknown addresses in which you are asked for a ransom in bitcoin to prevent your photos or videos in intimate behavior from being spread on the web or sent to your email contacts or social friends.

In the email it is assumed that your PC is infected with a malware that has filmed and stolen your data.

You will find a bitcoin address and an ultimatum, indicating a figure to be sent within a certain amount of time.

The email looks like this:

𝙸 𝚔𝚗𝚘𝚠, (your password), 𝚒𝚜 𝚢𝚘𝚞𝚛 𝚙𝚊𝚜𝚜𝚠𝚘𝚛𝚍.

𝙸 𝚗𝚎𝚎𝚍 𝚢𝚘𝚞𝚛 𝚌𝚘𝚖𝚙𝚕𝚎𝚝𝚎 𝚊𝚝𝚝𝚎𝚗𝚝𝚒𝚘𝚗 𝚏𝚘𝚛 𝚝𝚑𝚎 𝚗𝚎𝚡𝚝 𝚃𝚠𝚎𝚗𝚝𝚢-𝚏𝚘𝚞𝚛 𝚑𝚘𝚞𝚛𝚜, 𝚘𝚛 𝙸 𝚠𝚒𝚕𝚕 𝚖𝚊𝚔𝚎 𝚜𝚞𝚛𝚎 𝚢𝚘𝚞 𝚝𝚑𝚊𝚝 𝚢𝚘𝚞 𝚕𝚒𝚟𝚎 𝚘𝚞𝚝 𝚘𝚏 𝚐𝚞𝚒𝚕𝚝 𝚏𝚘𝚛 𝚝𝚑𝚎 𝚛𝚎𝚜𝚝 𝚘𝚏 𝚢𝚘𝚞𝚛 𝚕𝚒𝚏𝚎.

𝙷𝚒, 𝚢𝚘𝚞 𝚍𝚘 𝚗𝚘𝚝 𝚔𝚗𝚘𝚠 𝚖𝚎 𝚙𝚎𝚛𝚜𝚘𝚗𝚊𝚕𝚕𝚢. 𝙱𝚞𝚝 𝙸 𝚔𝚗𝚘𝚠 𝚎𝚟𝚎𝚛𝚢𝚝𝚑𝚒𝚗𝚐 𝚛𝚎𝚐𝚊𝚛𝚍𝚒𝚗𝚐 𝚢𝚘𝚞. 𝚈𝚘𝚞𝚛 𝚏𝚋 𝚌𝚘𝚗𝚝𝚊𝚌𝚝 𝚕𝚒𝚜𝚝, 𝚙𝚑𝚘𝚗𝚎 𝚌𝚘𝚗𝚝𝚊𝚌𝚝𝚜 𝚙𝚕𝚞𝚜 𝚊𝚕𝚕 𝚝𝚑𝚎 𝚟𝚒𝚛𝚝𝚞𝚊𝚕 𝚊𝚌𝚝𝚒𝚟𝚒𝚝𝚢 𝚒𝚗 𝚢𝚘𝚞𝚛 𝚌𝚘𝚖𝚙𝚞𝚝𝚎𝚛 𝚏𝚛𝚘𝚖 𝚙𝚊𝚜𝚝 𝟷𝟼𝟺 𝚍𝚊𝚢𝚜.

𝙰𝚗𝚍 𝚝𝚑𝚒𝚜 𝚒𝚗𝚌𝚕𝚞𝚍𝚎𝚜, 𝚢𝚘𝚞𝚛 𝚜𝚎𝚕𝚏 𝚙𝚕𝚎𝚊𝚜𝚞𝚛𝚎 𝚟𝚒𝚍𝚎𝚘, 𝚠𝚑𝚒𝚌𝚑 𝚋𝚛𝚒𝚗𝚐𝚜 𝚖𝚎 𝚝𝚘 𝚝𝚑𝚎 𝚖𝚊𝚒𝚗 𝚛𝚎𝚊𝚜𝚘𝚗 𝚠𝚑𝚢 𝙸 𝚊𝚖 𝚠𝚛𝚒𝚝𝚒𝚗𝚐 𝚝𝚑𝚒𝚜 𝚙𝚊𝚛𝚝𝚒𝚌𝚞𝚕𝚊𝚛 𝚎-𝚖𝚊𝚒𝚕 𝚝𝚘 𝚢𝚘𝚞.

𝚆𝚎𝚕𝚕 𝚝𝚑𝚎 𝚙𝚛𝚎𝚟𝚒𝚘𝚞𝚜 𝚝𝚒𝚖𝚎 𝚢𝚘𝚞 𝚠𝚎𝚗𝚝 𝚝𝚘 𝚝𝚑𝚎 𝚙𝚘𝚛𝚗 𝚠𝚎𝚋 𝚜𝚒𝚝𝚎𝚜, 𝚖𝚢 𝚖𝚊𝚕𝚠𝚊𝚛𝚎 𝚎𝚗𝚍𝚎𝚍 𝚞𝚙 𝚋𝚎𝚒𝚗𝚐 𝚝𝚛𝚒𝚐𝚐𝚎𝚛𝚎𝚍 𝚒𝚗𝚜𝚒𝚍𝚎 𝚢𝚘𝚞𝚛 𝚙𝚎𝚛𝚜𝚘𝚗𝚊𝚕 𝚌𝚘𝚖𝚙𝚞𝚝𝚎𝚛 𝚠𝚑𝚒𝚌𝚑 𝚎𝚗𝚍𝚎𝚍 𝚞𝚙 𝚜𝚑𝚘𝚘𝚝𝚒𝚗𝚐 𝚊 𝚋𝚎𝚊𝚞𝚝𝚒𝚏𝚞𝚕 𝚟𝚒𝚍𝚎𝚘 𝚌𝚕𝚒𝚙 𝚘𝚏 𝚢𝚘𝚞𝚛 𝚖𝚊𝚜𝚝𝚞𝚛𝚋𝚊𝚝𝚒𝚘𝚗 𝚊𝚌𝚝 𝚋𝚢 𝚝𝚛𝚒𝚐𝚐𝚎𝚛𝚒𝚗𝚐 𝚢𝚘𝚞𝚛 𝚌𝚊𝚖.

(𝚢𝚘𝚞 𝚐𝚘𝚝 𝚊 𝚞𝚗𝚚𝚞𝚎𝚜𝚝𝚒𝚘𝚗𝚊𝚋𝚕𝚢 𝚜𝚝𝚛𝚊𝚗𝚐𝚎 𝚝𝚊𝚜𝚝𝚎 𝚋𝚝𝚠 𝚕𝚖𝚏𝚊𝚘)

𝙸 𝚑𝚊𝚟𝚎 𝚝𝚑𝚎 𝚎𝚗𝚝𝚒𝚛𝚎 𝚛𝚎𝚌𝚘𝚛𝚍𝚒𝚗𝚐. 𝙸𝚏 𝚢𝚘𝚞 𝚏𝚎𝚎𝚕 𝙸 '𝚖 𝚙𝚕𝚊𝚢𝚒𝚗𝚐 𝚊𝚛𝚘𝚞𝚗𝚍, 𝚜𝚒𝚖𝚙𝚕𝚢 𝚛𝚎𝚙𝚕𝚢 𝚙𝚛𝚘𝚘𝚏 𝚊𝚗𝚍 𝙸 𝚠𝚒𝚕𝚕 𝚋𝚎 𝚏𝚘𝚛𝚠𝚊𝚛𝚍𝚒𝚗𝚐 𝚝𝚑𝚎 𝚙𝚊𝚛𝚝𝚒𝚌𝚞𝚕𝚊𝚛 𝚛𝚎𝚌𝚘𝚛𝚍𝚒𝚗𝚐 𝚛𝚊𝚗𝚍𝚘𝚖𝚕𝚢 𝚝𝚘 𝟹 𝚙𝚎𝚘𝚙𝚕𝚎 𝚢𝚘𝚞'𝚛𝚎 𝚏𝚛𝚒𝚎𝚗𝚍𝚜 𝚠𝚒𝚝𝚑.

𝙸𝚝 𝚌𝚘𝚞𝚕𝚍 𝚎𝚗𝚍 𝚞𝚙 𝚋𝚎𝚒𝚗𝚐 𝚢𝚘𝚞𝚛 𝚏𝚛𝚒𝚎𝚗𝚍, 𝚌𝚘 𝚠𝚘𝚛𝚔𝚎𝚛𝚜, 𝚋𝚘𝚜𝚜, 𝚖𝚘𝚝𝚑𝚎𝚛 𝚊𝚗𝚍 𝚏𝚊𝚝𝚑𝚎𝚛 (𝙸 𝚍𝚘𝚗'𝚝 𝚔𝚗𝚘𝚠! 𝙼𝚢 𝚜𝚘𝚏𝚝𝚠𝚊𝚛𝚎 𝚠𝚒𝚕𝚕 𝚛𝚊𝚗𝚍𝚘𝚖𝚕𝚢 𝚌𝚑𝚘𝚘𝚜𝚎 𝚝𝚑𝚎 𝚌𝚘𝚗𝚝𝚊𝚌𝚝 𝚍𝚎𝚝𝚊𝚒𝚕𝚜).

𝚆𝚘𝚞𝚕𝚍 𝚢𝚘𝚞 𝚋𝚎 𝚌𝚊𝚙𝚊𝚋𝚕𝚎 𝚝𝚘 𝚕𝚘𝚘𝚔 𝚒𝚗𝚝𝚘 𝚊𝚗𝚢𝚘𝚗𝚎'𝚜 𝚎𝚢𝚎𝚜 𝚊𝚐𝚊𝚒𝚗 𝚊𝚏𝚝𝚎𝚛 𝚒𝚝? 𝙸 𝚍𝚘𝚞𝚋𝚝 𝚝𝚑𝚊𝚝 ...

𝙷𝚘𝚠𝚎𝚟𝚎𝚛, 𝚒𝚝 𝚍𝚘𝚎𝚜 𝚗𝚘𝚝 𝚑𝚊𝚟𝚎 𝚝𝚘 𝚋𝚎 𝚝𝚑𝚊𝚝 𝚙𝚊𝚝𝚑.

𝙸 𝚠𝚊𝚗𝚝 𝚝𝚘 𝚖𝚊𝚔𝚎 𝚢𝚘𝚞 𝚊 𝟷 𝚝𝚒𝚖𝚎, 𝚗𝚘 𝚗𝚎𝚐𝚘𝚝𝚒𝚊𝚋𝚕𝚎 𝚘𝚏𝚏𝚎𝚛.

𝙿𝚞𝚛𝚌𝚑𝚊𝚜𝚎 𝚄𝚂𝙳 𝟸𝟶𝟶𝟶 𝚒𝚗 𝚋𝚒𝚝𝚌𝚘𝚒𝚗 𝚊𝚗𝚍 𝚜𝚎𝚗𝚍 𝚒𝚝 𝚝𝚘 𝚝𝚑𝚎 𝚋𝚎𝚕𝚘𝚠 𝚊𝚍𝚍𝚛𝚎𝚜𝚜:

1EGynC8hJMzXXXXXXX3NRD4AZK * V5Wsu28jdGB

[𝚌𝚊𝚜𝚎 𝚜𝚎𝚗𝚜𝚒𝚝𝚒𝚟𝚎, 𝚌𝚘𝚙𝚢 𝚊𝚗𝚍 𝚙𝚊𝚜𝚝𝚎 𝚒𝚝, 𝚊𝚗𝚍 𝚛𝚎𝚖𝚘𝚟𝚎 * 𝚏𝚛𝚘𝚖 𝚒𝚝]

(𝙸𝚏 𝚢𝚘𝚞 𝚍𝚘 𝚗𝚘𝚝 𝚔𝚗𝚘𝚠 𝚑𝚘𝚠, 𝚕𝚘𝚘𝚔𝚞𝚙 𝚑𝚘𝚠 𝚝𝚘 𝚋𝚞𝚢 𝚋𝚒𝚝𝚌𝚘𝚒𝚗. 𝙳𝚘 𝚗𝚘𝚝 𝚠𝚊𝚜𝚝𝚎 𝚖𝚢 𝚒𝚖𝚙𝚘𝚛𝚝𝚊𝚗𝚝 𝚝𝚒𝚖𝚎)

𝙸𝚏 𝚢𝚘𝚞 𝚜𝚎𝚗𝚍 𝚝𝚑𝚒𝚜 '𝚍𝚘𝚗𝚊𝚝𝚒𝚘𝚗' (𝚠𝚎 𝚠𝚒𝚕𝚕 𝚌𝚊𝚕𝚕 𝚒𝚝 𝚝𝚑𝚊𝚝?). 𝚁𝚒𝚐𝚑𝚝 𝚊𝚏𝚝𝚎𝚛 𝚝𝚑𝚊𝚝, 𝙸 𝚠𝚒𝚕𝚕 𝚐𝚘 𝚊𝚠𝚊𝚢 𝚊𝚗𝚍 𝚗𝚎𝚟𝚎𝚛 𝚌𝚘𝚗𝚝𝚊𝚌𝚝 𝚢𝚘𝚞 𝚊𝚐𝚊𝚒𝚗. 𝙸 𝚠𝚒𝚕𝚕 𝚎𝚛𝚊𝚜𝚎 𝚎𝚟𝚎𝚛𝚢𝚝𝚑𝚒𝚗𝚐 𝙸'𝚟𝚎 𝚐𝚘𝚝 𝚊𝚋𝚘𝚞𝚝 𝚢𝚘𝚞. 𝚈𝚘𝚞 𝚖𝚊𝚢 𝚟𝚎𝚛𝚢 𝚠𝚎𝚕𝚕 𝚔𝚎𝚎𝚙 𝚘𝚗 𝚕𝚒𝚟𝚒𝚗𝚐 𝚢𝚘𝚞𝚛 𝚗𝚘𝚛𝚖𝚊𝚕 𝚍𝚊𝚢 𝚝𝚘 𝚍𝚊𝚢 𝚕𝚒𝚏𝚎 𝚠𝚒𝚝𝚑 𝚣𝚎𝚛𝚘 𝚏𝚎𝚊𝚛.

𝚈𝚘𝚞 𝚑𝚊𝚟𝚎 𝟸𝟺 𝚑𝚘𝚞𝚛𝚜 𝚒𝚗 𝚘𝚛𝚍𝚎𝚛 𝚝𝚘 𝚍𝚘 𝚜𝚘. 𝚈𝚘𝚞𝚛 𝚝𝚒𝚖𝚎 𝚜𝚝𝚊𝚛𝚝𝚜 𝚊𝚜 𝚜𝚘𝚘𝚗 𝚢𝚘𝚞 𝚌𝚑𝚎𝚌𝚔 𝚘𝚞𝚝 𝚝𝚑𝚒𝚜 𝚎 𝚖𝚊𝚒𝚕. 𝙸 𝚑𝚊𝚟𝚎 𝚐𝚘𝚝 𝚊𝚗 𝚜𝚙𝚎𝚌𝚒𝚊𝚕 𝚌𝚘𝚍𝚎 𝚝𝚑𝚊𝚝 𝚠𝚒𝚕𝚕 𝚝𝚎𝚕𝚕 𝚖𝚎 𝚊𝚜 𝚜𝚘𝚘𝚗 𝚊𝚜 𝚢𝚘𝚞 𝚛𝚎𝚊𝚍 𝚝𝚑𝚒𝚜 𝚎𝚖𝚊𝚒𝚕 𝚝𝚑𝚎𝚛𝚎𝚏𝚘𝚛𝚎 𝚍𝚘𝚗'𝚝 𝚊𝚝𝚝𝚎𝚖𝚙𝚝 𝚝𝚘 𝚊𝚌𝚝 𝚜𝚖𝚊𝚛𝚝.

As you can see, they claim that they know your password, which makes many people panicking.

But let's stay calm.

What do we have to do?

Exclusively trash the email with a big laugh.

In most cases this is a classic phishing email sent to thousands of people, taking some stolen database containing your email and password.

No one has pierced your pc, no one has taken your data and no one has your email contacts.

You can even have a laugh by going to see on the bitcoin blockchain explorer how the address you were given is totally empty and without transactions.

To be on the safe side, do a check of your pc with a good antimalware and avoid certain "happy" sites to spend time.

And if you really have to, stick a piece of tape over your laptop's webcam.

Follow our cybersecurity guide to avoid this unpleasant kind of thing.

Check next Scam HERE!

Security Guide for Newbies - Save the user

SECURITY.

You have 10 bitcoins.

Have you read them?

Bang!

Well now they're gone.

You screwed up, you were careless, you lost everything.

Because your security sucks. You didn't think long term and you were lazy. Laziness is for sloths, not for you.

Security and managing the security of any wallets in the crypto world is critical.

In this world there are no banks that can save you or help you, or people paid to help you if you lose passwords, private keys or if you are robbed.

Security is your duty and obligation. If you want to hold crypto, even in small amounts, you must follow some rules.

Remember that security and all the work you are doing here is to secure your coin. Security is not comfortable, is more like riding a motorcycle in the summer heat with a leather suit, that is not comfortable. But it is safe, and a comfortable service is unsafe. And we want SAFETY.

Let's go through an important, but not completely exhaustive, list of things you must do and not do.

We know that some things may be exaggerated, but you never know.

THINGS TO DO

Starting from scratch:

Back up of any private keys of each wallet. Private keys are also known as SEED.

The SEED is the set of words, which can be 12 or 24, that allows the wallet to be recovered if the wallet is lost or updated, depending on how the software works.

Always remember that whoever owns the seed, owns the coins.

Back up exchange access.

Always make a copy of the exchange access passwords and the e-mails that are used.

Of course protect the email password as well.

Back up the 2FAs.

Copy the QRs code of the 2FAs, make sure that you have a copy of any QR. Without 2FA you will not be able to access the exchanges.

Back up your phone for 2FAs.

If you have an old smartphone that you no longer use, you can use it to act as a Backup phone

Hide everything.

Needless to say, you can do as many back ups as you want, but if you leave something lying around, maybe written on some papers with the title "bitcoin wallet" and someone comes by and this person knows what to do....

And then remember where you hide your back up and what you put there.

Keep wallets updated.

Updates are done to improve services and to plug the holes that every system invariably has. Keeping wallets updated is a good and right thing.

Choose the right wallet.

Best to use one wallet per coin or per network type, example ERC20 or BSC

Multicoin and multi-network wallets can have larger security holes given the use of "exotic" coins that very often have only initial development and over time become insecure at the software level.

Use open source software.

Communities that make use of open source software in blockchain are communities that aspire to continuously improve the product. Best to rely on these people.

Check addresses after a copy - paste

There is a hacker attack that is called “Clipboard attack”. Your device has been infected with malware that recognizes the addresses of some coins and replaces the address you entered with another. So if you are withdrawing coins from an exchange, it replaces the address on your wallet with the one decided by the hacker when you go to copy paste. Always check that the address is correct. Dont be lazy.

Bookmark exchanges.

By bookmarking exchange addresses, beware of pishing attacks and clone websites created just to steal data from you. By using links in favorites you will be more sure that you are on the correct address.

Generate wallets only when you are alone.

You never know who is watching around you. Generating a bitcoin wallet in the middle of a square full of people is not very safe.

Know the Scams.

Follow our guide to learn how scams work and thus, not to get scammed yourself.

Maintain anonymity as much as possible.

There are crypto investor communities that are interesting to join, especially thanks to telegram. But we never know who is behind that screen . Be careful and study the situation before participating.

In case of robbery.

If they are unfortunately after your crypto wallets because you were unlucky or stupid, prepare in advance a wallet that is expendable with a low amount of money. But congruous with your big mouth. Idiot.

THINGS NOT TO DO

Lose back ups.

If you lose the papers or flash drives, you have lost access to the wallets.

If you misplace passwords or worse, misplace private keys, you can say goodbye to your coins.

This is the most frequent way to lose possession of coins, far more frequent than any scam.

Be careful where you write seeds

Do not write seed with a pencil but with a pen. Do not kick with a pen; a malicious person could retrieve your seed.

Then if use paper as temporary, destroy the paper with a shredder.

Do not use markers that could write part or all of the seed on underlying papers.

Do not use Clouds.

Do not put passwords, login information or seeds into any Cloud, even if you consider them hyper secure. Clouds can be hacked and this data leaked.

Pay attention to how you use your "notepad."

Do not lend your cell phone if you have a wallet in it.

Pure logic.

No photos with cell phones.

Do not take password or seed photos with your cell phone. Your cell phone may be hacked, you may forget to delete the photo, and you may lose your cell phone.

Buy a hardware wallet.

Do not have hardware wallet sent to your home.

Do not have hardware wallets sent to your home address, but use other addresses that cannot be traced back to you. Security flaws and data theft at Ledger have left all of the company's customer information at the mercy of hackers. It doesn't take long to realize that your data can be bought and used to harm you.

Don't leave clues.

Never leave behind papers, notes, or signs that might indicate your possession of cryptocurrency.

If you leave seed and password sheets around, your cleaning lady might betray you or sell you to someone. Or your wife might throw away some papers with random words written on.

Don't go around telling people that you have cryptocurrencies or how many you have. Stay in the shadows.

If someone should ask, answer that it is a subject you have studied but you have never owned anything, that you have never invested any money in them. There are people around who could harm you, who could threaten your family and your loved ones.

Do you really want to risk having your daughter killed only to fool around at the Club with those 4 assholes of your friends?

Safety rules for any exchange.

Always remember that the moment you signed up, you are vulnerable to be hacked.

You may have your password stolen. So use a password that is complex but different from the other services you usually use. A password that is the same as other sites can be a problem -

es Binance vs. small book seller. Understand that the investments in security between the two services are not comparable. It should be added that your email is easily traceable and this would give possible access to your funds if you have not protected yourself with another layer of protection such as 2FA

For this reason, always activate 2FA. But do not activate it from the email, Thats a bad choice.

Remember that the biggest flaw in any service is you, with your unintentionally careless behaviors.

We suggest making an email for exchanges, using privacy-oriented services such as Protonmail's.

For password creation you can think of something long consisting of several words yourself or using a program such as a password manager. Remember that a password created by the pc with numbers and letters is impossible to remember, while a password created with a phrase or set of words that make sense to you can be remembered more easily. We prefer a passphrase.

Again, for each exchange use a different password.

In case you use a password manager, you only have to remember the passphrase to access the service.

Never abandon coin on exchanges.

Because exchanges are a risk, coins that remain on the 'exchange can be stolen in the event of an attack. Do not leave coin to do anything on any exchange.

Coins can be left on some exchanges to create a passive income. But this is discussed in another article.

Another important point is that only coins should be left on exchanges to trade and that you are willing to lose in case of a security breach.

NFT - a complete Theorical Guide

NFT or Non-fungible Token, an acronym we are hearing more and more around the world.

But what is an NFT? What does fungible mean? How can it impact our lives?

A fungible something is a good that can be exchanged for another good of the same species. Money is the simplest example since I can exchange a 10 dollar bill for another 10 dollar bill without changing its economic function.

10 dollars is still 10 dollars

A non-fungible asset, on the other hand, is an asset that we can consider unique such as works of art, hand-built cars, etc.

Digital assets on blockchain fall under this last description of "scarcity" even when when in the digital world we can create thousands of the same images with the click of a mouse.

In fact, the creation of an NFT token is a technological process and not the creation of a product.

When you create an NFT you assign a distinctive serial number to something on the blockchain and there is no additional information about what that particular token is or serves.

NFT then can be applied to different product categories that may change our world.

This has created the stream of Crypto Art.

We are not art experts but we can define Crypto Art as a movement with a distinct aesthetic given the possibility of creating NFTs.

CryptoArt are rare digital artistic works associated with unique tokens that exist on the blockchain. This token allows the 'work of art” to be bought and sold as a real physical painting, and as with a real painting, there is only one. At least it should be that the concept of buying Crypto Art.

If we take a look inside an artistic NFT token, sold on the blockchain, we would find that the NFT token or tokens do not contain the artwork because it is too big. You can upload the images on the blockchain but it would be really too expensive. In fact, the token is linked to the art pieces, but these artistic pictures are uploaded somewhere else on the network.

The correct way to link a token to a piece of art is through a hash that can be used on a decentralized darknet, which is simply a network not indexed by search engines and therefore theoretically unreachable without knowing the exact input address.

Since the hash is a unique cryptographic key, it cannot be replicated and the hash becomes the identity of the file and one can verify if the two match.

With this hash, it does not matter where the work file is located.

For example, the hash of the most famous NFT work, namely the beeple work is this:

QmXkxpwAHCtDXbbZHUwqtFucG1RMS6T87vi1CdvadfL7qA

It does not matter where the work is posted, the current owner in case of sale will have the opportunity to produce the file that will match the hash.

For those who want a copy of the work in a known place, darknets can be used for this solution. The blockchain from decentralized transactions, a darknet from a decentralized file exchange service. The most famous is bit torrent.

The link to Beeple's work is this: ipfs://ipfs/QmPAg1mjxcEQPPtqsLoEcauVedaeMH81WXDPvPx3VC5zUz

The NFT token points to a metadata file that contains the 'original hash” within which all the information of the work is kept and in fact as in the blockchain, we are looking at a chain of hashes

So if we ask where the artwork is, the answer is that our NFT contains an hash that points to a darknet.

But not all NFTs point to a darknet. They may point to an address that is not decentralized. This could be a problem because we don't know how eternal that address is. The server owner could shut it down and goodbye to our work of art.

Now if you are wondering how to buy an Artistic NFT token, you should know that NFT tokens can be sold both on and off the blockchain.

In fact, Beeple's work was sold by Christies.

The change of ownership of the famous NFT was at 0 cost and the monetary transaction was through normal banking circuit, but this was a lucrative exception.

Contracts in NFTs follow the ERC721 standard, which allows them to be managed by other smart contracts

With any NFTs you do not have the actual ownership of the thing you have paid but you have the control of the ownership.

Control over the token but not over the artwork. This issue needs specific legislation and differ from country to country.

In fact I can buy an NFT representing a work of art, but if I buy an NFT representing a tweet on twitter, do I own the tweet? Or do I own the rights of the tweet?

What if I buy a meme? Who owns a meme?

More importantly, I could buy NFTs that have no connection to the actual author of the meme, having been created by people who "stole" his work. Who owns the evolution of the meme?

The major descriptions found around about NFTs describe what they pretend to be, but not what they really are.

An NFT is a token that represents a thing. It is not the work of art. It is a token that points to a work of art. It is a receipt of purchase of that artwork, only on blockchain.

If we go into the details of the steps of the creation of Beeple's NFT artwork

- Beeple created the artwork file

- It created the unique hash that identifies it

- Created the metadata file that includes the 'hash of the artwork

- Created the hash of the metadata file

- Uploaded both files to the ipfs decetralized darknet

- Created a token on the ethereum blockchain

- Christies creates an auction for the token

- The auction ends at $69 million in ethereum. However, there is no record of payment on blockchain

- Beeple transfers the token to the auction winner

BUT ultimately what was bought for $69 million.

A token. Which redirects you to an internet address.

So, now the owner of the token have the rights to transfer the token to someone else.

There is no mention of rights, copyright or even the artwork. Even beeple could create a copy of it with imperceptible changes and sell it with another token. Which I don't think he will do, but purely not to jettison his good name in the art world.

This leads us to understand the value of things based on an objective and subjective point of view. In fact, subjective value depends on preferences, beliefs, perceptions and our habits.

In case of collections, collectibles, subjective value is everything.

In fact, this kind of market has always existed, but hype is high with NFTs. Collectible figurines have always been sought after, and in the digitizing world, the NBA has tapped into NFTs by going on to create a market for tokens featuring the most beautiful clips of the best plays of basketball players.

In this article we talked about art and then moved on to collectibles. Technically any asset could be tokenized via NFTs given their representation on Blockchain, assuming legislation goes hand in hand with technology.

In fact, blockchain would solve many real-world issues because of its 6 key properties, namely :

Standardization, interoperability, tradeability, liquidity, immutability, programmability.

Let's go into the details of these key properties that we will need in the future:

Standardization:

Digital assets have existed since 'the beginning of the computer age on different platforms that are not compatible with each other. Think of the video games we would have liked to play....

Creating NFT tokens on the blockchain, any creators applies the same type of contract to all tokens creating uniformity of the standard

This allows NFT ownership, tranfers and access /control unified in one common system

If I buy 3 NFTs on 3 different platforms but with same standard these can or could interact with each other.

Where are NFTs?

The most developed blockchain today is ethereum.

There are 3 types of token standards most commonly used on the blockchain and they are ERC 721, ERC 998 and ERC 1155

ERC stands for Ethereum Request for Comments and is similar for BIP or Bitcoin Improvement Proposal.

ERC is basically how developers can propose improvements to the network. The numbers refer to the identities of the unique ones proposed

ERC 721 was used in 2018 and became famous with cryptokitties, a game on blockchain in which people could buy and sell kittens and each cat was an NFT token

The 721 standard allows the creation of tokens with different values and attributes, with various differences on the same smart contract and the token can be transferred into the same ecosystem

ERC 998 is a token that allows to create a bundle,to group separate, unequal ERC 721 tokens that can be bought and sold in one transaction.

Assume a car video game, where I will have 50 unique parts such as engine body etc. with which I will created my dream car. All of these parts will be ERC 721 tokens that I will sell in a single transaction since the all 50 NFT create my car in the video game.

ERC 1155 initially created for Enjin, an ecosystem on ethereum where applications can be created by developers. This standard allows the creation of both fungible and non-fungible tokens and their coexistence and interaction. Imagine again the car game we take example before, where all players start with one standard car and then as they progress, the users can buy cars that are only limited in number. Like the player starts with a Mazda Miata. but there are only 10 ferrari 250 GTOs in the game.

This is the standardization

Interoperability:

Since all tokens use the same standard, they run on the same platform. So anyone who creates an NFT of any kind, will be able to sell it a the marketplace of their choice or on all those on the enabled platform.

This pushes tradeability, it allows anyone to have access to a free and open marketplace and an operator can create, launch and sell an entire NFT into the “ecosystem”. This could revolutionize video games because anyone could participate in adding content to video games

Liquidity, a fast and efficient market leads to liquidity. Liquidity indicates a level of activity in the market, how many people are buying and how often in that market.

Immutability, a piece of data when confirmed and written on the blockchain is immutable, so this leads to the demonstration of authenticity of the digital asset as NFT and demonstrates its scarcity

Programmability. NFTs are totally programmable so they are extremely complex and creatable everything.

The sky is the limit with programming, developing and using the tokens.

Another one problems that we can find in platforms dedicated to artists and sales of their works is the forgery and double sale of their works.

In fact, it is very easy for a scammer to copy profiles and works of a famous artist on another selling platform, sell real but stolen tokens, and pocket the ethereum.

If we are interested in works of a certain cost and depth, the most useful thing to do is to check the artist's social and website and check that we are buying an NFT on a platform with a legitimate profile of him.

What has happened to the NFT market? Summer 2022

Like all markets affected by a huge rise in price and popularity, the market deflated, prices collapsed, and speculation came to a halt. Now there is the prospect of a clean sweep in what the next NFTs will be.

This is not necessarily a bad thing; on the contrary, this cleansing will bring out the real projects that bring value and are worth keeping in the portfolio.

In addition, NFTs will also begin to be used for other initiatives in the near future.

Updated 13/10/2022

FOMO

FOMOOOOOOOOOOOOOOOO

What does this word mean?

Today we're going to explain a term that you surely read often, but that also has a deep meaning in the psychology of every trader.

FOMO means fear of missing out, and we could translate it as fear of having missed an opportunity, sometimes unrepeatable.

We can also see it as a social anxiety for having missed an interesting and very profitable investment train.

Fomo is one of the many biases working against you.

This feeling that you will feel deep inside will be a mixture of discouragement, anger towards yourself and frenzy to jump on the market without ifs and buts, without thinking and without having any regard to money management.

It's a feeling that is present especially now in the social media era, thank to the continuous updating of what other people are doing, the lifestyle that the social media of certain characters are selling us and their wealth.

You see on twitter and instagram unknown kids becoming millionaires overnight, driving around Dubai sitting in bentleys and surrounded by fabulous models, all accompanied by articles and pictures of their bank accounts at various zeroes.

And you're in your bedroom, in your underwear, guzzling a cola. It's obvious that you want to do what they do and have their lifestyle.

However, this emotion of envy you're feeling leads you to follow some advice that could be bad for your wallet.

Right now you're susceptible to those articles in blogs with titles like "the 5 coins you can't not have in your portfolio" or "XX's untameable growth" or "expected 200% return with YY".

To which we have to add all the messages that you read in the various chats, which promote things never heard that in most cases are scams.

And then you enter in the optics that "now or never" on some unknown coin, you buy it exaggerating and you throw away all your past gains.

You don't have to do that, it's not a competition and you don't have to buy things that in a normal situation you would have never bought.

And on top of that you are left with the anger of having thrown money away and you can only take it out on yourself.

This is why we talk so often about managing emotions and anxiety.

If you had stopped to think, none of this would have happened or you would have allocated a much smaller amount.

You've gone overboard with your level of risk

Now let's face it, social media are fake.

They are a mirror of what we would like to be and that we somehow make others see. But that we are not.

When we see these millionaire kids, their success is exaggerated to sell you one of their products.

Most of the successes of those we follow on social are exaggerated narratives.

The cars, jewelry and private planes are definitely rentals and the incredible models are only friends of their cousin or prostitutes.

None of these champions talk about their mistakes and losses but all they talk about are the victories and the fantastic billions they are making. Some even get paid to foment fomo or to sell scams or useless courses or useless books.

Now back to us, generally the rule to earn is buy low and sell high, which is very logical but in most cases if a stock is low, mentally evaluate the situation as negative, if it is high it is positive and you think it will go up again.

This is possible, but what if the uptrend is over?

If everyone is rushing to buy Ethereum after a 200 percent rise, you are compromising your risk level just because you are following the crowd, you are following the hype.

And the hype is the enemy

You're acting on the urgency to do something and that's not good because as you know deep down, returns are not guaranteed.

The fomo, the frenzy doesn't make you think rationally and doesn't deepen what you're putting your money on.

If you get caught up in the frenzy to buy after you've seen a post on some social, stop for a moment and think

who is making the post on social networks? Is he a serious and reliable person, is he an idiot?

Is he someone who knows something about it or is he a bum with no experience at all?

These questions can stop you from making some careless purchases.

And always remember that limited time windows in most cases hide nasty surprises.

I don't doubt that some of the axles being touted could be the new Tesla, but being cautious is always best.

You might feel like an idiot for missing an opportunity or will you be an idiot for losing all your money?

Keep calm and study.

5 steps to start investing

Getting started is not particularly difficult if you have a clear path in mind, otherwise you flounder left and right without doing anything, throwing your money away.

Investing needs to have specific goal in mind, whether it is to improve your economic situation or have funds to buy a house or to finance our business. We want to grow our capital so that we can then use it for ourselves.

Step n 1

Check your expenses and understand how you spend.

That is, where does the money go?

Understanding how you spend is the key to cutting unnecessary expenses and saving to start investing.

Let's see it this way, the money you will save will be the gasoline for your investments.

And your investments are like a car, without petrol you just stop and look around.

Now, after understanding how you spend, you have to choose how to allocate your budget.

Many suggest the 50 30 20 rule, which is 50% necessary expenses, 30 discretionary expenses and 20% savings.

You need to be disciplined but this also depends on what fixed expenses you have, such as a home or car loan.

Try to apply yourself on your personal sphere and your situation.

Step n2

Pay off debts.

Having a debt such as a mortgage or car payment is not a big problem, because they are debt that we can consider useful.

At the end of the mortgage you will have a house, we can call it a real estate value.

On the contrary, having a mortgage for an iphone or a television is not very smart.

Surely you can avoid spending that money on consumer electronics or other things that can be considered useless.

In fact, every debt has a cost, and you are paying for your iPhone more than what it costs in the store.

The costs of the debts you have on whatever you have bought must be checked, and if possible pay off these debts ASAP.

Remember we need gasoline for our car.

Step n3

Create an emergency fund.

It seems counterintuitive, cutting debt to have more money to spend on financial assets and then creating a fund with money that we shouldn't touch except in an emergency. Instead it makes sense, specifically for your psyche and for your safety.

In fact, you must be prepared to have fluctuations in your financial portfolio, with whatever asset you have formed it.

An emergency fund lets you know that in the event of any problem in your life, you can have a safety net to draw on.

Think about if you lose your job and don't find one for a few months. How could you live and pay the bills?

3 to 6 months of funds to live without work can be a good start for creating an emergency fund.

You can also make it grow over time, shifting some of your earnings.

The emergency fund will also allow you to have extra security when you go to invest.

Your psyche must be ready to handle the stress of financial positions.

Step n4

Understand if you can invest on your own or if you need help

In this case, you have to be honest with yourself.

Do you know what to do? Can you handle it psychologically?

Investing is not easy and burning an account is very easy.

Your psyche is risk averse and you need to learn to manage it.

Your risk tolerance may be higher or lower, but the pain for losses is real.

You have to understand how to manage anxiety and this leads you to wonder if you can do it alone or if you need a consultant.

If you believe you can do it yourself, then a long, very long course of study awaits you.

But it will enrich you and allow you to understand a lot of things about our world and our society.

Step n 5

Start today, with discipline.

The earlier you start, the better, because with the passing of age the attention decreases and because the longer you stay on the market, the greater your chances of earning.

Discipline requires you not to do things rashly, to remain balanced as investments and never, ever make the famous ALL INNN on the set-up that everyone is pushing during a Hype- Assett period.

Because you will know that it is the stupidest thing to do, especially when everyone is on FOMO.

Hype is the enemy.